According to Knight Frank, the number of exchanges in November – the most recent month with full data – in prime London markets was 16.2% higher than the same month in 2021 and 15% higher than the five-year average1. Given that the markets were still shaking out the mini-budget, this is an encouraging sign.

LonRes found that average prices across prime London continued to recover through 2022 and, thanks to a 4.4% rise across 2022 as a whole, average per sq ft prices were just 1.4% below their previous 2015 peak. However, Knight Frank notes that buyers remain wary, especially in lower-value markets where they rely on debt. The number of offers made in Q4 was 12% below the five-year average, reflecting the uncertainty that has arisen from the spike in borrowing costs. However, as the falling five-year swap rate shows, mortgage rates should continue to decline, which means the fall in offers made could recover.

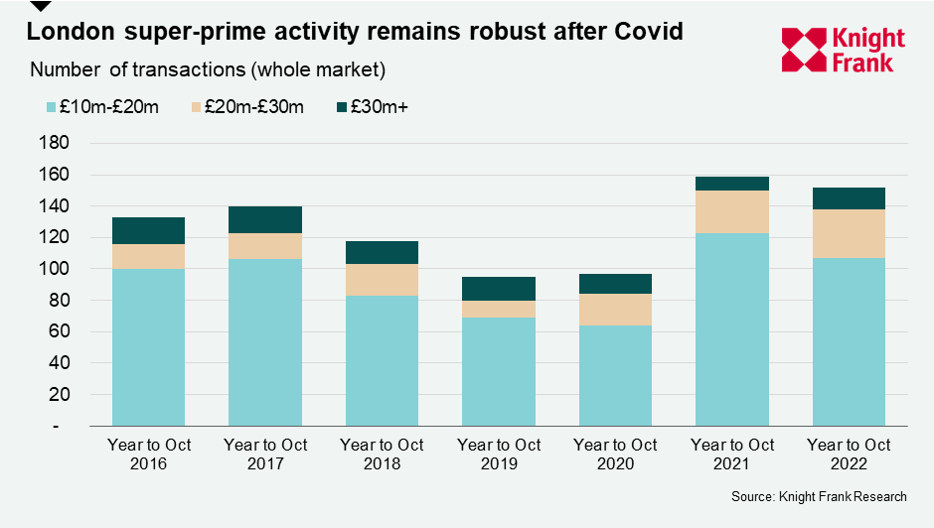

Meanwhile, the number of offers accepted in Prime London was 24% above the five-year average in Q4, which suggests that any nervousness from prospective buyers will not lead to a substantial fall in sales volumes. The resilience of prices in prime London is set to be tested this spring when activity levels traditionally pick up across the UK. The release of pent-up demand following Brexit and Covid uncertainty boosted activity in London’s £10 million-plus property market. There were 152 super-prime sales in the year to October 2022, whole-market data shows.

The preference for houses, rather than flats continued through 2022, but with some signs that flats were regaining desirability2.

1 Knight Frank: Residential Review Q1 2023

2 LonRes: Prime London Market Update, Winter 2022/23

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023