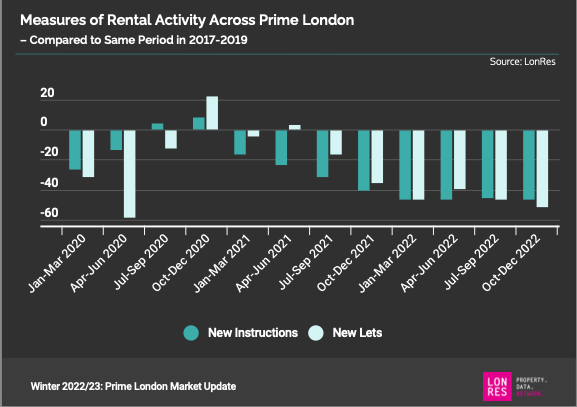

LonRes, in its latest Winter report, notes that – in sharp contrast to the Pandemic period, where supply in Prime London rose sharply as tenants disappeared – 2022 saw a complete reversal: as tenants returned, there was a severe shortage of property to rent, which inevitable led to rapid rental growth over the year.

Knight Frank3 found that on the demand side of the equation, new prospective tenants were 26.7% above the five-year average in November and as, a direct consequence, average rental values in prime central London ended the year 17.8% higher, or 23.2% above their pre-pandemic average. In prime outer London, the equivalent year end figure for new tenants was 15.8%, driving rents 21.1% above their level in March 2020.

There are some signs of supply improving in the higher value markets and this may filter down to lower markets in 2023. Mortgage rates are expected to be up to 2 percentage points higher in the coming Spring than at the same time in 2022, squeezing what buyers are willing to pay. While some sellers may accept lower prices, others may decide that letting their property is a better strategy – a choice that we noted in our Q3 2022 newsletter, and which is still there. Double digit rental growth could well encourage this thinking. Average time on the market has also hit record lows.

There are also other signs: The average discount to asking rents fell to near zero in 2022, with some months recording a premium, according to LonRes, with tenants offering more than asking rents on average. The proportion of rental homes with reductions in asking prices fell significantly – though around 1 in 10 still recorded a discount. While some markets may see tenant affordability limit rent rises, this is unlikely to be a major factor in super Prime London areas.

3 Knight Frank: Prime London Rental Index – December 2022

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023