A wide array of sale indicators has shown little change over the past year in Prime London where prices have been broadly flat according to Savills. Knight Frank record just a 0.1% increase over Q1 2023. Savills concludes that realistic pricing is the key to driving activity levels.

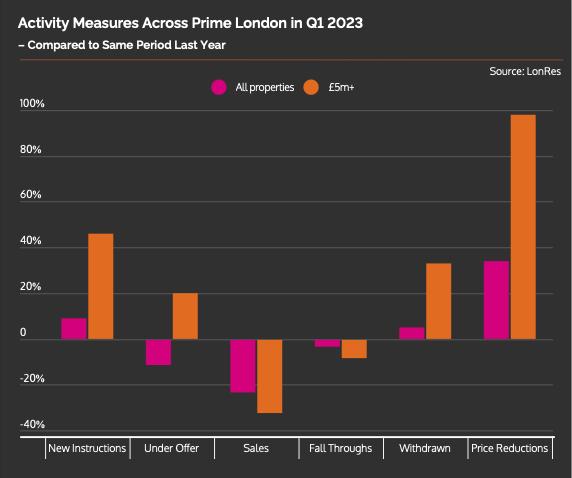

Leading indicators are showing that prime London sales are on track to return to pre-Pandemic levels, according to LonRes. Data for February shows that while the number of properties sold during the month was 33% lower than 2022, – a rebound year after the pandemic – it was just 9.1% lower than the 2017-19 average, while overall sales volumes fell in Q1 2023 compared to Q1 2022. However, the number of properties under offer – seen as a leading indicator – was 10.5% higher than the pre-pandemic average.

The average discount to asking price has edged up – having been pushed down by the post-Pandemic rebound – and houses that stay on the market longer are seeing steeper discounts. However, LonRes data for February suggests the average discount to asking price has increased irrespective of the time it takes to sell. The current discount for homes selling in under three months is now -3.5% while the discount for those selling in six to twelve months is -9.6%, which again shows the importance of getting the price right in the current market.

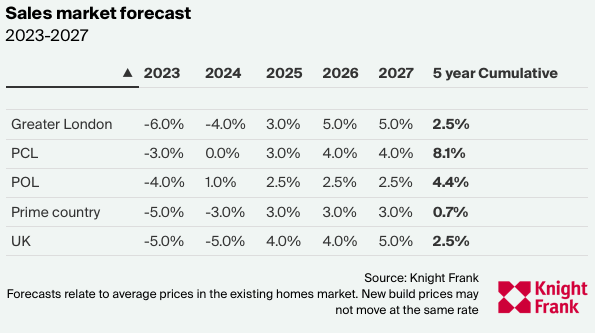

Because of the more solid than expected start to 2023, Knight Frank has revised its forecasts, with overall UK prices expected to return more strongly to growth by 2025 – now forecast to be 4%, compared to 2% in the last forecast – with Prime Outer London returning to a modest 1% growth in 2024, and Prime Central London a 0% growth in 2024 and 3% in 2025. With prospective buyers in February 10% above the five-year average, and accepted offers 42% above that average, Knight Frank sees the possibility of revisiting these forecasts before Summer.

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023