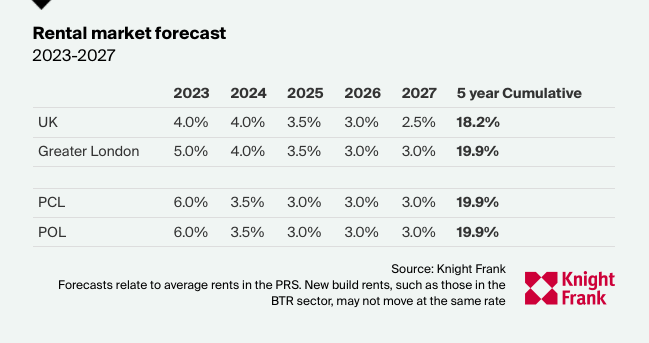

The frenetic market of the last 18 months has calmed down but not disappeared, Knight Frank report. Annual rental growth in March 2023 was 16.9% in Prime Central London and 15.2% in Prime Outer London, which were the lowest annual changes since November 2021 and compare with 25%+ at the same time in 2022. One factor sustaining growth is a better than expected sales market meaning that rental supply has, since Christmas, not increased as much as some anticipated. This led to new listings in February being down by around a third compared to the five-year average.

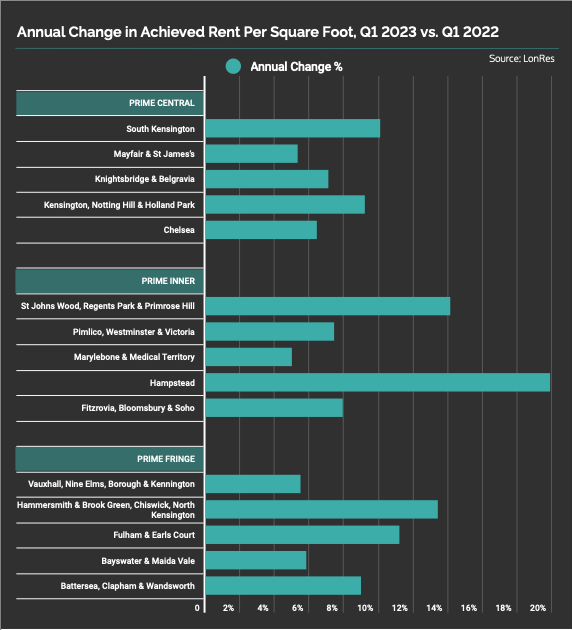

According to LonRes, rental growth across prime London remained high in Q1 but “slowed from the frantic pace of the previous 18 months”. The latest LonRes prime London Rental Index recorded annual growth of 9.3% after a quarterly rise of 0.6%.

This included Prime Central London seeing a small quarterly fall in rental values of 0.6% in Q1 2023, following strong growth in Q4 2022, while rents in Prime London Fringe grew by 3.1% after lower rises in the second half of 2022.

With capital values broadly static, average yields have been growing across prime London, reaching 4.18% in Q1 2023. This is the highest level since 2012 and is a significant rise from their recent low of 3.28% in Q4 2020.

Savills found that average prime gross yields across London have risen significantly over the past three years, but remained steady during Q1 2023. However, flats continued to see increasing returns with rental growth outpacing capital value growth across all regions.

All measures of leasing activity were down compared to a year ago, constrained by lack of stock, according to LonRes. Competition among tenants in the second half of last year was so strong that properties were achieving 100.5% of their asking rent on average in September 2022. This has fallen to 97.8% in March but remains well above longer-term average levels.

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023