Average London prices rose to £472,204 in June, 12.6% higher than a year earlier according to data released in the new UK House Price Index. House prices across the capital are expected to soften as a result of the vote to leave the EU, but the rate of growth achieved across the whole of London remained considerably higher than England as a whole (9.3%).

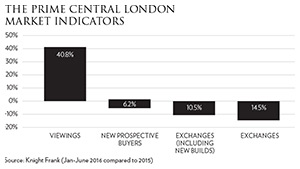

In prime central London, prices have already begun to soften. Knight Frank report that while viewings across prime central areas were 40.8% higher in the first half of 2016 than the same period in 2015, transactions and new buyer numbers fell. Annual house price growth in the sub-£1 million market remains positive at 1.1% although across prime central areas as a whole annual growth fell to -1.5% in July, with properties priced £5-£10 million witnessing the greatest decline. This reflects a continuation of the slowdown since the last peak in annual growth of 8.1% back in June 2014 which followed significant rises during 2009-2013. It is also an indication that vendors who adapt to the changing landscape in the capital, can sell appropriately priced properties without a reduction. Vendors who have not taken into consideration two stamp duty hikes or the Brexit uncertainty need to be more realistic to achieve a sale.

In prime central London, prices have already begun to soften. Knight Frank report that while viewings across prime central areas were 40.8% higher in the first half of 2016 than the same period in 2015, transactions and new buyer numbers fell. Annual house price growth in the sub-£1 million market remains positive at 1.1% although across prime central areas as a whole annual growth fell to -1.5% in July, with properties priced £5-£10 million witnessing the greatest decline. This reflects a continuation of the slowdown since the last peak in annual growth of 8.1% back in June 2014 which followed significant rises during 2009-2013. It is also an indication that vendors who adapt to the changing landscape in the capital, can sell appropriately priced properties without a reduction. Vendors who have not taken into consideration two stamp duty hikes or the Brexit uncertainty need to be more realistic to achieve a sale.

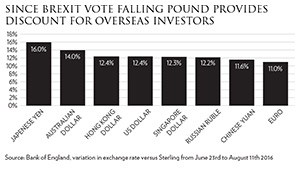

It is also likely that the recent downward re-pricing, along with the fall in sterling witnessed since the Referendum may stimulate market activity. Across Belgravia and Knightsbridge in the weeks immediately following Brexit, activity has been relatively brisk according to Knight Frank. The pound has fallen 12% against the dollar since the vote (as at 11th August), offering US dollar-denominated buyers an effective 12% discount. For purchasers from Japan, properties are effectively 16% cheaper. RICS report that confidence amongst surveyors in the demand across the London market is at a seven-month high and with political stability having been restored, financial markets re-balanced and the lure of London from a cultural and academic perspective apparently untarnished from the result, savvy investors may well seek opportunities to purchase.

It is also likely that the recent downward re-pricing, along with the fall in sterling witnessed since the Referendum may stimulate market activity. Across Belgravia and Knightsbridge in the weeks immediately following Brexit, activity has been relatively brisk according to Knight Frank. The pound has fallen 12% against the dollar since the vote (as at 11th August), offering US dollar-denominated buyers an effective 12% discount. For purchasers from Japan, properties are effectively 16% cheaper. RICS report that confidence amongst surveyors in the demand across the London market is at a seven-month high and with political stability having been restored, financial markets re-balanced and the lure of London from a cultural and academic perspective apparently untarnished from the result, savvy investors may well seek opportunities to purchase.

HMR Housing Market Report July 2016

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023