The Homelet Rental Index showed annual rents across the UK and Greater London continuing to rise in July, albeit at a slower rate than a year ago. Across Greater London average rents rose by 4% in the year to July, higher than the UK as a whole (2.3%), but far slower than the rise of 9.5% recorded in the year to July 2015.

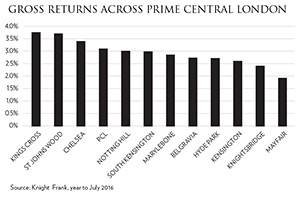

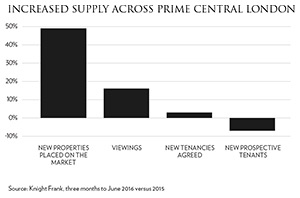

Across prime central London, Knight Frank report a 3.6% reduction in average rents in the year to July, as stock increased while demand remained fairly static, primarily as a result of uncertainty in the global economy. In the three months to June, 49% more properties came to the market compared to a year ago – boosted by investments made before the April SDLT deadline and disappointed vendors switching to the rental market as the prime London sales market weakened. With more choice for tenants, landlords are increasingly pragmatic on rents to minimise void periods. Despite the number of prospective tenants falling by 7% in the three months to June compared to last year, viewings and tenancies agreed have been more positive and with the Royal Institute of Chartered Surveyors reporting a modest rise in demand into July there are hopes that the summer, usually the busiest time, will be strong. Yields are 3.1% across PCL but have dropped below 2% in Mayfair. Investors in King’s Cross can achieve income returns of 3.7%.

Across prime central London, Knight Frank report a 3.6% reduction in average rents in the year to July, as stock increased while demand remained fairly static, primarily as a result of uncertainty in the global economy. In the three months to June, 49% more properties came to the market compared to a year ago – boosted by investments made before the April SDLT deadline and disappointed vendors switching to the rental market as the prime London sales market weakened. With more choice for tenants, landlords are increasingly pragmatic on rents to minimise void periods. Despite the number of prospective tenants falling by 7% in the three months to June compared to last year, viewings and tenancies agreed have been more positive and with the Royal Institute of Chartered Surveyors reporting a modest rise in demand into July there are hopes that the summer, usually the busiest time, will be strong. Yields are 3.1% across PCL but have dropped below 2% in Mayfair. Investors in King’s Cross can achieve income returns of 3.7%.

While there remain concerns following Brexit over the long term commitment of some companies to London, as yet these are unfounded. In fact, with the currency benefit due to the fall in Sterling, Knight Frank assert that relocation budgets for many, have risen. They report 11% more tenants with a budget of £1,500 per week in the three months to 24 July compared to the same period in 2015, bringing more locations within their reach.

While there remain concerns following Brexit over the long term commitment of some companies to London, as yet these are unfounded. In fact, with the currency benefit due to the fall in Sterling, Knight Frank assert that relocation budgets for many, have risen. They report 11% more tenants with a budget of £1,500 per week in the three months to 24 July compared to the same period in 2015, bringing more locations within their reach.

Knight Frank PCL Rental index July 2016

Homelet Rental Index, July 2016

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023