The current climate in the UK and London is one of uncertainty, driven by a number of factors. A rise in interest rates has been cause for speculation for some months and although there is little doubt interest rates will indeed rise next year, the expectation of an immediate rise has diminished slightly, given the further economic deterioration in Europe. Lower than expected increases in inflation, keeping it well below the 2% target, will also encourage the Bank of England to delay a rise in interest rates in the very near future. Notwithstanding the fact that growth in the UK economy is likely to top most other European nations this year, with recent news that even Germany may now be on the verge of its third recession since the crisis, European-wide economic decline will undoubtedly continue to have repercussions in the UK – some negative, some positive.

The scheduled introduction, in April 2015, of the Annual Tax on Enveloped Dwellings (ATED) on properties over £500k owned by companies that are not property investors or developers, combined with the lowering, in March 2014, of the 15% Stamp Duty Land Tax (SDLT) threshold to include properties over £500k owned by companies that are not property investors or developers, has added some additional uncertainty to the market, albeit not substantial as it effectively excludes buy-to-let properties. However, what has caused more uncertainty is the upcoming UK general election in May and the possible introduction of the so called ‘Mansion Tax’, which would apply to all properties valued over £2m.

Last year’s budget announcement that, from April 2015, non-residents will have to pay a UK Capital Gains Tax (CGT) when selling any residential properties in the UK, has also created some skepticism in the market. However, we do not expect this to have a major impact on the market, as in effect it simply brings the UK in line with many other countries. In any case, international property buyers would first have to make a profit on the sale of their property in order to pay any CGT, so that should not deter investors unduly.

The new limits being imposed on mortgage lenders by the Financial Policy Committee (FPC) from October 2014, mean the proportion of mortgages that lenders can make on multiples greater than 4.5 times earnings is limited to a maximum of 15%. Data from the Council of Mortgage Lenders (CML) shows the proportion of such loans in London is 19%, while in the UK it is 9%. Although these limits may have a negative impact on the market, we believe for the most part this will be offset by the fact that there are considerably more cash buyers in London than in the rest of the UK. Finally, we do not believe the Mortgage Market Review (MMR), which imposes more rigorous scrutiny of household outgoings, and which took effect in April 2014, has so far had any noticeable repercussions on the new homes market in London and the UK.

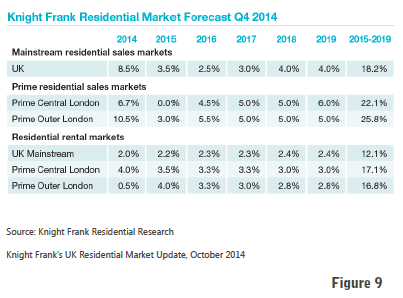

With this much uncertainty, it is not surprising the rate of growth in prices for prime central London (PCL) properties has declined in recent months. According to Knight Frank, in the second quarter of the year, the number of new potential buyers fell by 20% compared to the previous year’s figures and total viewings fell by 15%. However, the rate of property exchanges declined by only 1% in the same period and annual growth in PCL prices rose for the 47th consecutive month in September 2014, following their peak in June. Over the next couple of years, it is expected growth in sales prices will continue across the UK and PCL, but at declining rates until the market stabilises at growth levels of around 4% and 5% respectively. At the same time, growth in rental rates in the same areas is predicted to continue on its upward trajectory until it too stabilises at slightly lower growth levels of around 2% in the UK and 3% in PCL (see figure 9). Even at an overall annual return of 8%, prime central London property will still remain a very attractive asset class.

With this much uncertainty, it is not surprising the rate of growth in prices for prime central London (PCL) properties has declined in recent months. According to Knight Frank, in the second quarter of the year, the number of new potential buyers fell by 20% compared to the previous year’s figures and total viewings fell by 15%. However, the rate of property exchanges declined by only 1% in the same period and annual growth in PCL prices rose for the 47th consecutive month in September 2014, following their peak in June. Over the next couple of years, it is expected growth in sales prices will continue across the UK and PCL, but at declining rates until the market stabilises at growth levels of around 4% and 5% respectively. At the same time, growth in rental rates in the same areas is predicted to continue on its upward trajectory until it too stabilises at slightly lower growth levels of around 2% in the UK and 3% in PCL (see figure 9). Even at an overall annual return of 8%, prime central London property will still remain a very attractive asset class.

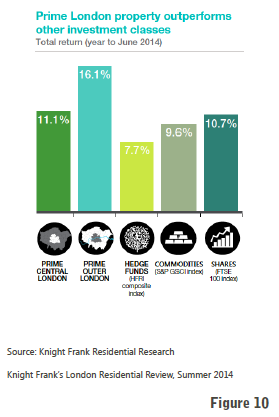

According to Knight Frank, foreign buyers now make up less than half of super-prime central London property buyers. This is a drop from 64% in 2013 and 73% in 2012. This decline at the £10m+ end of the market could be the result of a combination of factors: the increasing value of sterling, the recent changes to residential property taxes in the UK, the increase in the number of home-grown billionaires, and the perception Europe is over the worst. However, with the recent news that even the stronghold economies of Europe are at risk of falling back into recession, we can assume there will still be plenty of foreign investors looking to purchase £1m+ PCL properties, though their profile may be changing somewhat. The decline in China’s economy and continuing unrest in Ukraine are also positives for the UK property market. London’s appeal remains well-founded and PCL property is still regarded as a safe haven, especially while overall investment returns, which cover capital value growth and rental income, remain strong. At 11.1% in the 12 months to June 2014, PCL property returns are still outperforming most other asset classes (see figure 10).

According to Knight Frank, foreign buyers now make up less than half of super-prime central London property buyers. This is a drop from 64% in 2013 and 73% in 2012. This decline at the £10m+ end of the market could be the result of a combination of factors: the increasing value of sterling, the recent changes to residential property taxes in the UK, the increase in the number of home-grown billionaires, and the perception Europe is over the worst. However, with the recent news that even the stronghold economies of Europe are at risk of falling back into recession, we can assume there will still be plenty of foreign investors looking to purchase £1m+ PCL properties, though their profile may be changing somewhat. The decline in China’s economy and continuing unrest in Ukraine are also positives for the UK property market. London’s appeal remains well-founded and PCL property is still regarded as a safe haven, especially while overall investment returns, which cover capital value growth and rental income, remain strong. At 11.1% in the 12 months to June 2014, PCL property returns are still outperforming most other asset classes (see figure 10).

- Knight Frank’s UK Residential Market Update, October 2014;

- Knight Frank’s London Residential Review, Summer 2014;

- Knight Frank’s Super-Prime London Insight, Q2 2014.

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023