Rents across England and Wales experienced their first monthly increase since autumn 2015, according to the Your Move buy-to-let index, rising by 0.1% from January to February 2016. Annual rental growth across London was 4.8%, well above the average for England and Wales of 3.3%.

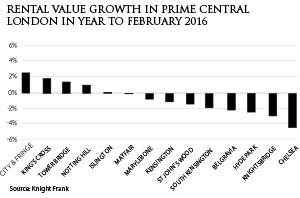

The Royal Institute of Chartered Surveyors (RICS) reported that tenant demand rose robustly for fourteen months in succession. Knight Frank figures suggest this led to annual rental values in prime central London experiencing sustained growth from July 2014 to January 2016. Demand was boosted by the introduction of various property related taxes which turned potential buyers to the rental market. However, annual rental growth eased off in March 2016, falling 1%, the lowest rate since May 2014. This was a result of an increase in supply of rental properties – buoyed up by potential vendors deciding to become landlords, rather than accept lower sale prices on their properties. This 1% average fall in rental growth hid considerable geographic variation, with the less expensive districts further east, closer to London’s financial district, such as City & Fringe and Kings Cross recording growth of 2.2% and 1.8% respectively. These areas have outperformed the wider prime market with lower rents and proximity to the City, attracting financial sector workers. The number of tenancies agreed in the first two months of the year was up 12% on the 2015 figure as a result of landlords being more realistic about values and agreeing on rent reductions to let properties.

The Royal Institute of Chartered Surveyors (RICS) reported that tenant demand rose robustly for fourteen months in succession. Knight Frank figures suggest this led to annual rental values in prime central London experiencing sustained growth from July 2014 to January 2016. Demand was boosted by the introduction of various property related taxes which turned potential buyers to the rental market. However, annual rental growth eased off in March 2016, falling 1%, the lowest rate since May 2014. This was a result of an increase in supply of rental properties – buoyed up by potential vendors deciding to become landlords, rather than accept lower sale prices on their properties. This 1% average fall in rental growth hid considerable geographic variation, with the less expensive districts further east, closer to London’s financial district, such as City & Fringe and Kings Cross recording growth of 2.2% and 1.8% respectively. These areas have outperformed the wider prime market with lower rents and proximity to the City, attracting financial sector workers. The number of tenancies agreed in the first two months of the year was up 12% on the 2015 figure as a result of landlords being more realistic about values and agreeing on rent reductions to let properties.

In the past, activity in the rental sector tended to rise at the beginning of the year, on the back of confidence in the financial services industry in anticipation of substantial bonus payments, but Bloomberg reports that despite record mergers and acquisitions activity ($3.8 trillion in 2015), uncertainty in global financial markets has reduced bonuses by up to 15%. Now bankers are less certain about their bonus, activity previously seen early in the year tends to be postponed.

In the past, activity in the rental sector tended to rise at the beginning of the year, on the back of confidence in the financial services industry in anticipation of substantial bonus payments, but Bloomberg reports that despite record mergers and acquisitions activity ($3.8 trillion in 2015), uncertainty in global financial markets has reduced bonuses by up to 15%. Now bankers are less certain about their bonus, activity previously seen early in the year tends to be postponed.

- Your Move Buy to Let Index, March 2016

- Knight Frank PCL Rental Index, March 2016

- RICS Residential Market Survey, February 2016

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023