Average rents across the capital rose by just 0.9% in the year to August, according to the Office for National Statistics, with Rightmove indicating that average asking rents across the capital in Q3 2017 were at their lowest level since 2013. Across prime central areas, Knight Frank report that rental values fell by just 0.1% in the three months to September, the smallest quarterly decline in almost two years. Tenant demand rose faster than new supply in September, according to the latest RICS survey. September is traditionally a strong month for rentals with the new academic year and graduate job intakes. However, if demand continues to outstrip supply in the months ahead, it could put upward pressure on rental values.

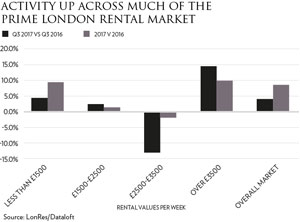

Across prime central areas, there were 4.1% more properties let between June and September compared to the same period in 2016. Ultra-prime properties have witnessed a surge of interest during the last quarter, with LonRes reporting that over fifty properties were let across prime London with rental values of over £5000 per week, compared to less than twenty during the same period last year.

Across prime central areas, there were 4.1% more properties let between June and September compared to the same period in 2016. Ultra-prime properties have witnessed a surge of interest during the last quarter, with LonRes reporting that over fifty properties were let across prime London with rental values of over £5000 per week, compared to less than twenty during the same period last year.

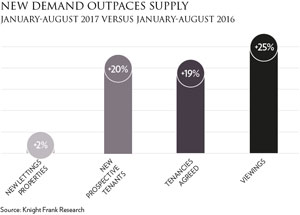

Despite tax changes and a subsequent fall in buy-to-let mortgage approvals, it is clear that there has been no significant exodus of landlords across the market. In fact, Knight Frank report a 9.6% increase in landlords re-letting their properties between January to August compared to the same period last year, with the number of new tenancies agreed up 19% on last year. The average length of tenancy for a prime residential property is also increasing. According to Savills, this is now 17.7 months, up from just 13.1 months five years ago. This trend looks set to continue, with an increasing number of tenants looking to rent for the long term due to both convenience and ever-increasing housing affordability pressures.

Despite tax changes and a subsequent fall in buy-to-let mortgage approvals, it is clear that there has been no significant exodus of landlords across the market. In fact, Knight Frank report a 9.6% increase in landlords re-letting their properties between January to August compared to the same period last year, with the number of new tenancies agreed up 19% on last year. The average length of tenancy for a prime residential property is also increasing. According to Savills, this is now 17.7 months, up from just 13.1 months five years ago. This trend looks set to continue, with an increasing number of tenants looking to rent for the long term due to both convenience and ever-increasing housing affordability pressures.

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023