According to LSL Property Services’ Buy-to-Let Index, the annual growth in rental rates in England and Wales rose to 3% in December 2014, significantly higher than its previous peak of 2.4% in August, and a far cry from its lowest annual rise of just 0.6% seen last April. In fact, average rental rates are still close to the record levels achieved in October, with 80% of regions seeing higher rents than the previous year, which is unusual for December. In London, the picture was even more positive with a record annual increase in rents of 4.1% and a monthly increase of 0.9%, which is the third highest monthly rise this year and a significant turnaround from the 0.9% fall in rates we had seen in January 2014.

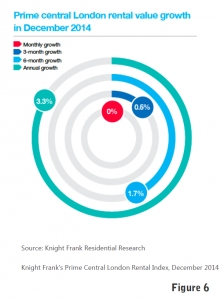

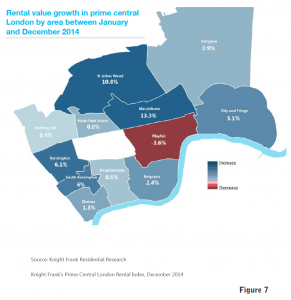

In prime central London (PCL), according to Knight Frank’s Rental Index, after rising for eight consecutive months, average monthly rental rates remained at 0% for a second month, following a 0.5% increase in October 2014. Although the monthly rate of growth has levelled off, it is now the sixth consecutive month in which annual growth in rental rates has been positive. In fact, at 3.3% for the 12 months to December 2014, it is the highest it has been for the past 36 months (see figure 6). The prediction that growth rates would be back in the black by July were clearly correct and the longest period of decline since the inception of the Knight Frank index is well and truly over. Quarterly PCL figures show an increase of 0.5% since September 2014, which is the fourth consecutive quarterly rise. Marylebone, St. John’s Wood, and Kensington were the areas with the highest annual growth in rental values (see figure 7).

In prime central London (PCL), according to Knight Frank’s Rental Index, after rising for eight consecutive months, average monthly rental rates remained at 0% for a second month, following a 0.5% increase in October 2014. Although the monthly rate of growth has levelled off, it is now the sixth consecutive month in which annual growth in rental rates has been positive. In fact, at 3.3% for the 12 months to December 2014, it is the highest it has been for the past 36 months (see figure 6). The prediction that growth rates would be back in the black by July were clearly correct and the longest period of decline since the inception of the Knight Frank index is well and truly over. Quarterly PCL figures show an increase of 0.5% since September 2014, which is the fourth consecutive quarterly rise. Marylebone, St. John’s Wood, and Kensington were the areas with the highest annual growth in rental values (see figure 7).

The Knight Frank data also shows there has been a marked difference in the growth of rental values in different price brackets. Between January and November 2014, PCL properties valued at under £1,500 per week grew at 2.9%, while those valued at over £1,500 per week grew 3.8% over the same period. The picture for super-prime properties valued at £5,000 plus per week was also very positive compared to the previous year, which would indicate relocation budgets for top senior executives are increasing.

The Knight Frank data also shows there has been a marked difference in the growth of rental values in different price brackets. Between January and November 2014, PCL properties valued at under £1,500 per week grew at 2.9%, while those valued at over £1,500 per week grew 3.8% over the same period. The picture for super-prime properties valued at £5,000 plus per week was also very positive compared to the previous year, which would indicate relocation budgets for top senior executives are increasing.

The downward shift in the rental market began in mid-2012, when many jobs were lost in the financial sector. According to Knight Frank’s data, rental rates began to recover gradually in the first quarter of 2014, hitting positive figures by July and rising consistently throughout the last six months of the year. As the UK economy looked to be improving – in the second quarter the size of the economy had actually grown 2.7% above its peak before the downturn – and other major economies faltered, rental values were further buoyed by the lack of confidence surrounding the upcoming general election and the possibility of additional property taxes, namely the so called ‘Mansion Tax’, which has temporarily put some buyers off committing to a purchase until outcomes are clear. In November, yields on PCL properties were up again, this time to 2.92% from 2.9% the previous month, bringing yields close to 3%, a rate which has not been achieved for over a year and a half.

According to LSL Property Services, a similar picture is being seen across England and Wales. Gross yields on rentals increased to 5.1% in October 2014, up from 5.0% in September, and remained stable during the final two months of the year, though they ended the year slightly lower than the 5.3% seen in December 2013. Average total annual returns stood at 11.1% by the end of 2014, a fair bit higher than the 9.2% seen in December 2013, but a slight decline on the 12% seen in November 2014. According to LSL, with total annual returns well over 10%, average rent rates up, and yields steady all bodes well for those looking to invest in the rental market during 2015. By December 2014, London was averaging a monthly gross yield of 4.3%, up from the 4.2% seen in both September and October, and back to the level seen in August 2014.

- LSL Property Services Plc’s Buy-to-Let Index, October and December 2014;

- Knight Frank’s Prime Central London Rental Index, October, November, and December 2014;

- Knight Frank’s London Residential Review, Winter 2015.

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023