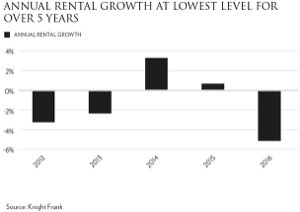

Annual rental prices across the UK rose by 2.3% in November according to the Office of National Statistics, a similar level of increase to the last five months. Prices across Greater London however, have fallen by 4.4% according to Rightmove (Q4 2016 and Q4 2015) and in prime areas they are down by 5.1% in the year to December according to Knight Frank, as high stock levels here have impacted on prices.

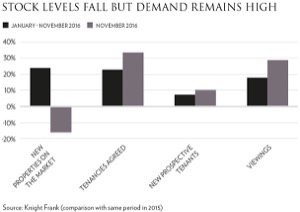

While prices have fallen, demand in the prime London rental market remains robust. Across the market Knight Frank report that both the number of new tenancies agreed and viewings were up in November compared to a year ago. However, for the first time in 2016, the number of new properties placed on the market fell. This may prove to be the start of rental values bottoming out after rental values last peaked in May 2015.

While prices have fallen, demand in the prime London rental market remains robust. Across the market Knight Frank report that both the number of new tenancies agreed and viewings were up in November compared to a year ago. However, for the first time in 2016, the number of new properties placed on the market fell. This may prove to be the start of rental values bottoming out after rental values last peaked in May 2015.

Landlords have no doubt been affected by falling rental values, along with the increased taxation imposed on a second property purchase. The Council of Mortgage Lenders report that mortgage advances to buy-to-let landlords in the six months since the introduction of the 3% second home levy are almost 50% lower than in the corresponding period in 2015. Add to this the impending tax changes that will fall on investors from April and the level of new supply may well be constrained. This looks likely to stabilise rental prices in what has been, until now, a tenant’s market.

Landlords have no doubt been affected by falling rental values, along with the increased taxation imposed on a second property purchase. The Council of Mortgage Lenders report that mortgage advances to buy-to-let landlords in the six months since the introduction of the 3% second home levy are almost 50% lower than in the corresponding period in 2015. Add to this the impending tax changes that will fall on investors from April and the level of new supply may well be constrained. This looks likely to stabilise rental prices in what has been, until now, a tenant’s market.

Similarly to the sales market, the impact of global economic activity on the prime London rental market is important. Economic uncertainty has led to a weakening of demand among company executives; however Knight Frank report the number of new prospective tenants rose by 10% in November as many markets witnessed an uptick in activity from those who had delayed decisions until after the US presidential election.

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023