As the BRIC countries, particularly Russia, India, and China, continue to generate substantial wealth, they are spurring growth in prime property markets across the world. London remains one of the most important cities to these ultra-high-net-worth-individuals (UHNWI), as it is still considered a safe haven for international wealth, for both political and economic purposes.

Fo example, according to a BBC News article on 24 March 2014, “Russians are amongst the top five biggest-spending tourists in the UK,” and in the short-term the recent situation in the Crimean peninsula has clearly affected tourism from Russia to London. “Finance company Global Blue said unrest and the effects of a weakening economy left Russians disinclined to travel.” The article also reported UK hotels and shops saw their income from Russians decrease by 17% in February, compared to the previous year, as the number of visitors declined due to the political turbulence in Ukraine. However, although it is too early to establish exactly what impact the current political situation in Russia will have on the London property market, it appears Russians may be considering relocating to London. In the long-term, the Crimean troubles may actually further buoy the prime central London (PCL) property market, as wealthy Russians flock to a politically and economically safer London.

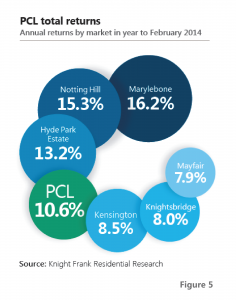

Overall investment returns in PCL residential property remain strong at 10.55% in the 12 months to March 2014. Due to the increasing sales prices the market has been seeing, PCL property returns are currently outperforming stocks, bonds, and other assets. The PCL areas with the strongest returns in the year to February 2014, were Marylebone with 16.2%, Notting Hill with 15.3%, and Hyde Park Estate with 13.2% (see figure 5).

Overall investment returns in PCL residential property remain strong at 10.55% in the 12 months to March 2014. Due to the increasing sales prices the market has been seeing, PCL property returns are currently outperforming stocks, bonds, and other assets. The PCL areas with the strongest returns in the year to February 2014, were Marylebone with 16.2%, Notting Hill with 15.3%, and Hyde Park Estate with 13.2% (see figure 5).

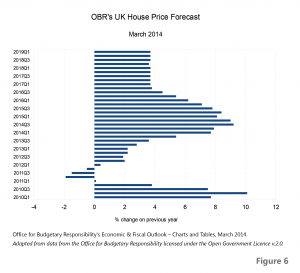

GV believes the PCL market remains strong as international demand continues unabated. Political and economic instability worldwide continues to spark demand and property price growth in PCL, with the Office for Budget  Responsibility’s (OBR) latest Economic & Fiscal Outlook forecasting property price rises in the UK into 2019, albeit at declining rates (see figure 6). Although the recent changes in the tax regime extended their reach to smaller properties (£500k+) owned by companies, we believe the effect on the property market will be negligible, as the impact of the same changes in the £2m+ band in 2012 left the market unaffected.

Responsibility’s (OBR) latest Economic & Fiscal Outlook forecasting property price rises in the UK into 2019, albeit at declining rates (see figure 6). Although the recent changes in the tax regime extended their reach to smaller properties (£500k+) owned by companies, we believe the effect on the property market will be negligible, as the impact of the same changes in the £2m+ band in 2012 left the market unaffected.

- BBC.com, Russian tourist spending in UK sees sharp fall in February, 24 March 2014;

- Knight Frank’s Prime Central London Rental Index, February and March 2014;

- Office for Budgetary Responsibility, Economic & Fiscal Outlook – Charts and Tables, March 2014, licensed under the Open Government Licence v.2.0.

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023