During the first quarter of 2014, the 2015 general election in the UK seemed a long way off and there was little, if any, effect on the property market. However, by the second and third quarters the level of uncertainty over the possible results of the election began to rise conspicuously, as more talk began to circulate about the notion of a ‘Mansion Tax’ being introduced should Labour win the election. As a result, the increase in the growth rate of average London house prices visibly diminished following a peak in August 2014, and the market lost some of its momentum. It is highly likely this uncertainty will continue to have an impact on the market until the conclusion of the election in May 2015.

In the Autumn Statement for 2014, the Chancellor announced a rise in the Stamp Duty Land Tax (SDLT) charges for any properties valued at over £937,500, making the idea of a ‘Mansion Tax’ less plausible. The immediate effect of this may be that buyers become tougher negotiators, pushing sellers a little more on prices until they reach a price reflective of the increased taxes. We are already seeing some evidence of this taking place, but we believe just as the market adjusted fairly quickly to the rise in SDLT for £2 million+ properties in 2012, it will similarly adjust to this new rise. Following this latest increase in SDLT, the politicians in opposition will find it tough to find support for their proposed ‘Mansion Tax’ on the grounds prime central London (PCL) property is not taxed heavily enough. In fact, when one compares London taxation with cities of similar calibre around the world, such as Singapore, Hong Kong, Paris, and New York, London is actually amongst those with the highest taxes, although Singapore and Hong Kong do take the lead when it comes to stamp duty.

GV would advise investors looking to achieve higher capital appreciation to consider looking at areas outside the traditional ones. Buyers now appear to be striving to find investment opportunities further afield, away from previous hot spots such as Mayfair. The result being these surrounding areas are beginning to see their prices climb quite sharply. This happened in Marylebone in 2013, when the area saw double-digit growth, which subsequently eased to 3.5% in 2014. Similarly, Hyde Park Estate took the lead in PCL with an annual increase of 12.9% in 2014.

In addition to that we have seen a growing tendency amongst buyers to place less importance on purchasing properties in the more conventional areas and more importance on the specifications of the property and the amenities of the building. This has led to an increase in purchases of new-builds and a shift towards areas that are less prime, but where redevelopment has been taking place over the last few years. Similarly, there are other areas that have been earmarked by developers where there are a number of upcoming new-build schemes that could possibly outperform prime central London (PCL) in the coming years. In East London for example, growth has been boosted by the vicinity of the financial districts, while in South West London, growth has been sparked largely by the resurgence in domestic buyers searching for better value for money, in particular when it comes to additional space for expanding families not so easily accommodated in PCL.

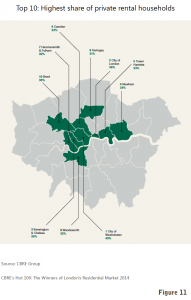

According to CBRE Group, the London property market has seen the private rented sector grow considerably over the last 10 years, with it now accounting for a notable 25% of all London households. The top ten areas with the highest number of renters (see figure 11) are popular for various reasons, including accessibility to financial centres and schools. In terms of PCL rental property, according to Knight Frank, about 20% of the UK’s properties in the £2 million plus bracket are in London, mainly within the prime boroughs of Kensington and Chelsea, and Westminster. Uncertainty remains over who would ultimately suffer the burden of the cost of a ‘Mansion Tax’, were it introduced following the upcoming election in May. While landlords may absorb some of the cost, they will need to either pass some of it on to renters or invest in cheaper properties in order to maintain their returns. Either way, the rental market would most likely be negatively affected, at least in the short-term.

According to CBRE Group, the London property market has seen the private rented sector grow considerably over the last 10 years, with it now accounting for a notable 25% of all London households. The top ten areas with the highest number of renters (see figure 11) are popular for various reasons, including accessibility to financial centres and schools. In terms of PCL rental property, according to Knight Frank, about 20% of the UK’s properties in the £2 million plus bracket are in London, mainly within the prime boroughs of Kensington and Chelsea, and Westminster. Uncertainty remains over who would ultimately suffer the burden of the cost of a ‘Mansion Tax’, were it introduced following the upcoming election in May. While landlords may absorb some of the cost, they will need to either pass some of it on to renters or invest in cheaper properties in order to maintain their returns. Either way, the rental market would most likely be negatively affected, at least in the short-term.

The question of how imminent a rise in interest rates might be was the subject of debate and speculation throughout 2014. By the fourth quarter, there was little doubt interest rates would increase during 2015, but the expectation of an immediate rise had diminished slightly, given the further economic deterioration in Europe. The latest sentiment being expressed by experts is with the Consumer Price Index (CPI) at 0.5%, compared to the 2% inflation rate the Bank of England is aiming for, interest rates may not rise until as late as 2016. Additionally, the GBP has been weakening against the USD for the last six months, which favours dollar-denominated investors.

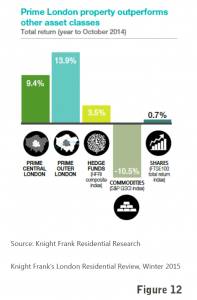

At GV we believe it is quite likely London prices will remain flat, with a low level of transactions this year, while Knight Frank forecasts growth of 3.5% for UK house prices in 2015. However, as it becomes more of a buyers’ market, better prices could be negotiated with willing sellers and hence, we believe it is a good time for investors to buy, although stock may be low. Our long-term view is the London property market will continue growing as foreign investors maintain their quest to diversify outside their own countries, with London retaining its status as a safe haven. Notwithstanding the uncertainty surrounding the forthcoming general election, we believe PCL property remains a strong investment choice and a very attractive asset class given its overall annual returns (see figure 12). We strongly believe while the London property market might slow down, or even level off in 2015, it will grow in the long-term.

At GV we believe it is quite likely London prices will remain flat, with a low level of transactions this year, while Knight Frank forecasts growth of 3.5% for UK house prices in 2015. However, as it becomes more of a buyers’ market, better prices could be negotiated with willing sellers and hence, we believe it is a good time for investors to buy, although stock may be low. Our long-term view is the London property market will continue growing as foreign investors maintain their quest to diversify outside their own countries, with London retaining its status as a safe haven. Notwithstanding the uncertainty surrounding the forthcoming general election, we believe PCL property remains a strong investment choice and a very attractive asset class given its overall annual returns (see figure 12). We strongly believe while the London property market might slow down, or even level off in 2015, it will grow in the long-term.

- Knight Frank’s Prime Central London Sales Index, December 2014;

- CBRE Group, Hot 100: The Winners of London’s Residential Market, 2014;

- Knight Frank’s London Residential Review, Winter 2015;

- Knight Frank’s UK Residential Market Update, January 2015.

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023