In prime central London (PCL) demand continues to be driven by international investors. Evidence that suggests prime residential property transactions mimic global indicators, such as the price of gold, also substantiates this view. Prime prices have remained relatively stable, which suggests PCL properties, especially those worth over £2m, are seen as stores of value rather than as speculative investment opportunities.

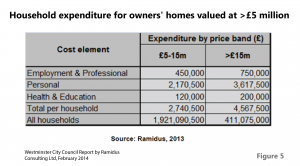

According to a new report recently published by Westminster City Council, overseas investment produces enormous wealth for the UK economy. Owners of properties valued over £15m each spend about £4.5m a year in London and owners in the £5m to £15m range each spend about £2.75m (see figure 5). Annually, over £2.3b is contributed to London’s economy, and the UK economy in general, by the owners of these high-end properties.

According to Councillor Robert Davis, Deputy Leader of Westminster City Council and Cabinet Member for the Built Environment, “This independent report also strongly counters the perception that overseas investors are buying high value properties in London as an investment and then leaving them empty.” In fact, the report found most of the £2m+ properties sold in Westminster in the nine years to 2012 are either occupied by the owners, or rented to London workers. In addition, the sales of these properties only represented 8% of the total number of transactions in Westminster, but accounted for over 40% of the value.

As outlined in our Market Report above, we are beginning to see a shift in the sales market. We now have a higher number of properties available for sale and the number of new buyers is starting to fall. It seems we might be moving towards a buyer’s market, with a larger choice of prime properties available. However, sellers do not yet seem ready to accept lower prices.

As outlined in our Market Report above, we are beginning to see a shift in the sales market. We now have a higher number of properties available for sale and the number of new buyers is starting to fall. It seems we might be moving towards a buyer’s market, with a larger choice of prime properties available. However, sellers do not yet seem ready to accept lower prices.

As already shown in figure 2 and supported by the Westminster City Council report, it is currently those properties valued under £2m, particularly apartments, which are garnering the most interest from buyers and sales at that end of the market are reflecting this.

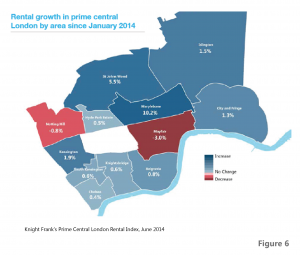

GV believes with employment figures for London up and rental rates still considered to be reasonable, there will be an increase in the number of London workers interested in renting, particularly with a rise in interest rates looming. As we said earlier, the rental market is just beginning to turnaround in most PCL areas (see figure 6) and we envisage rental yields increasing in the medium term, so this may be the perfect time to get ahead of the market and invest in buy-to-let properties.

GV believes with employment figures for London up and rental rates still considered to be reasonable, there will be an increase in the number of London workers interested in renting, particularly with a rise in interest rates looming. As we said earlier, the rental market is just beginning to turnaround in most PCL areas (see figure 6) and we envisage rental yields increasing in the medium term, so this may be the perfect time to get ahead of the market and invest in buy-to-let properties.

- Westminster City Council, The Prime Residential Market in Westminster, by Ramidus Consulting Ltd, 12 February 2014;

- Knight Frank’s Prime Central London Rental Index, June 2014;

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023