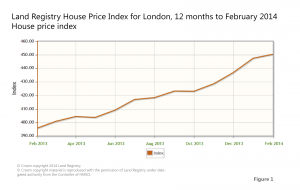

According to the Land Registry’s latest House Price Index (HPI), which captures actual changes in the value of residential properties, the price of property in England and Wales has increased by 5.3% in the last year. The region which experienced the greatest increase by far in its average property value over the last 12 months is London, with a movement of 13.8% (see figure 1). London property prices increased 5.1% in the three months to February 2014 alone.

According to the Land Registry’s latest House Price Index (HPI), which captures actual changes in the value of residential properties, the price of property in England and Wales has increased by 5.3% in the last year. The region which experienced the greatest increase by far in its average property value over the last 12 months is London, with a movement of 13.8% (see figure 1). London property prices increased 5.1% in the three months to February 2014 alone.

The two London boroughs with the highest average house prices by far remain Kensington and Chelsea, and City of Westminster. The annual increases in these boroughs were 14.8% and 15.8% respectively.

The number of £1m+ properties sold in London in December 2013, increased by 40% on December 2012 figures. Comparing the number of sales in the same months in the £2m+ bracket, the increase was again almost 40%, which shows the introduction of the new taxes on the £2m+ purchases have not affected the market.

According to Knight Frank, while annual growth rates in the wider London market remain in the double digits, price rises in prime central London (PCL) have seen their annual rate of growth decline to single digits compared to March 2012. Nevertheless, PCL prices increased 1.9% during the first quarter of 2014 and have now risen an impressive 68% since March 2009, when PCL property prices hit their lowest point during the financial crisis.

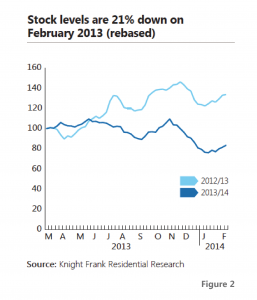

The growth rates at the highest end of the prime property scale, notably in the £10m+ bracket, also remain positive, but are now in the low single digits. The annual growth for these super high-end properties was 3.4% in February 2014, down from 6.1% the year before. The good news is that the stock levels of these same properties is 21% lower than it was last year, so this lack of supply should keep prices buoyant (see figure 2).

The growth rates at the highest end of the prime property scale, notably in the £10m+ bracket, also remain positive, but are now in the low single digits. The annual growth for these super high-end properties was 3.4% in February 2014, down from 6.1% the year before. The good news is that the stock levels of these same properties is 21% lower than it was last year, so this lack of supply should keep prices buoyant (see figure 2).

Knight Frank’s future House Price Sentiment Index (HPSI), which measures households’ future expectations of their property values over the next 12 months, saw a record high in March 2014, exceeding the previous high of the preceding month (see figure 3). For the 12th consecutive month the sentiment was that property values had continued to rise. Households across all 11 regions surveyed expressed an expectation that their property values would rise further in 2014. These expectations rose to a record high in London and this coming year, it is expected the market will see the highest price rises since early 2009.

Last year we estimate around 50% of all buyers of prime property, which we define as those exceeding £1m, in central London were foreign. These predominately hailed from Europe, Russia, and the Middle East.

When we talk about new-build properties in this same bracket, the influence of non-UK investors on the market over the past three years is even more evident, with closer to 75% of investors being non-UK nationals. Increasingly, these foreign nationals are originating from South East Asia and India. Apart from cultural reasons, this is most likely due to the fact that new-builds are favoured for investments, as they are easier to maintain for letting purposes.

- Land Registry House Price Index, February 2014 – © Crown copyright 2014 Land Registry. © Crown copyright material is reproduced with the permission of Land Registry under delegated authority from the Controller of HMSO;

- Knight Frank’s Prime Central London Sales Index, February 2014 and March 2014;

- Knight Frank’s House Price Sentiment Index (HPSI), March 2014.

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023