According to LSL Property Services’ Buy-to-Let Index, rental rates in England and Wales have only risen 0.9% in the last 12 months, which is the lowest annual increase in over four years. In London, the picture is a little more positive with an annual increase in rents of 1.3%, although on a monthly basis rents did fall 0.4% between February and March. However, according to Knight Frank’s Rental Index, the opposite is true in prime central London (PCL), where rental rates have now risen for the second time in the last three months, increasing 0.2% in March, but declining 2% compared to the same period last year. This is the longest period of decline since the inception of the Knight Frank index. Quarterly PCL figures show an increase of 0.1% since December 2013, which is the first quarterly rise in over two years and may be a sign that the market is nearing the end of its decline.

According to LSL Property Services’ Buy-to-Let Index, rental rates in England and Wales have only risen 0.9% in the last 12 months, which is the lowest annual increase in over four years. In London, the picture is a little more positive with an annual increase in rents of 1.3%, although on a monthly basis rents did fall 0.4% between February and March. However, according to Knight Frank’s Rental Index, the opposite is true in prime central London (PCL), where rental rates have now risen for the second time in the last three months, increasing 0.2% in March, but declining 2% compared to the same period last year. This is the longest period of decline since the inception of the Knight Frank index. Quarterly PCL figures show an increase of 0.1% since December 2013, which is the first quarterly rise in over two years and may be a sign that the market is nearing the end of its decline.

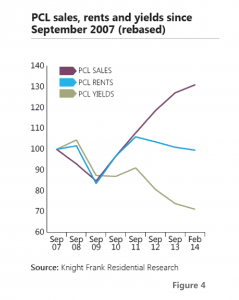

The downward shift in the rental market began in mid-2012, when many jobs were lost in the financial sector. Although, according to Knight Frank’s data, the total decline in PCL rent rates during this period was actually only in the region of 5%, the recovery has been slow. However, there is a growing sense of confidence in the UK economy and its financial sector, so the rental market is expected to turnaround soon (see figure 4).

With regards to annual gross yields on rentals, according to LSL Property Services, London is averaging a 4.5% return, while PCL properties are only yielding an average 2.83% return, according to Knight Frank.

- LSL Property Services Plc’s Buy-to-let Index, March 2014;

- Knight Frank’s Prime Central London Rental Index, March 2014;

- Knight Frank’s UK Residential Market Update, March 2014.

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023