Just under a quarter (24%) of leases in London expired between April and June compared to nearly a third (32%) across the UK, cushioning the London market to some degree during the height of the COVID-19 pandemic (Dataloft Rental Market Analytics). The number of new lets agreed across prime London in April and May was 80% lower than the same period a year ago as corporate lets all but disappeared as travel halted. Knight Frank report new instructions across prime London in April and May consistently above the same period last year, with 2,000 properties brought to the market across prime central and prime London during June (LonRes).

Just under a quarter (24%) of leases in London expired between April and June compared to nearly a third (32%) across the UK, cushioning the London market to some degree during the height of the COVID-19 pandemic (Dataloft Rental Market Analytics). The number of new lets agreed across prime London in April and May was 80% lower than the same period a year ago as corporate lets all but disappeared as travel halted. Knight Frank report new instructions across prime London in April and May consistently above the same period last year, with 2,000 properties brought to the market across prime central and prime London during June (LonRes).

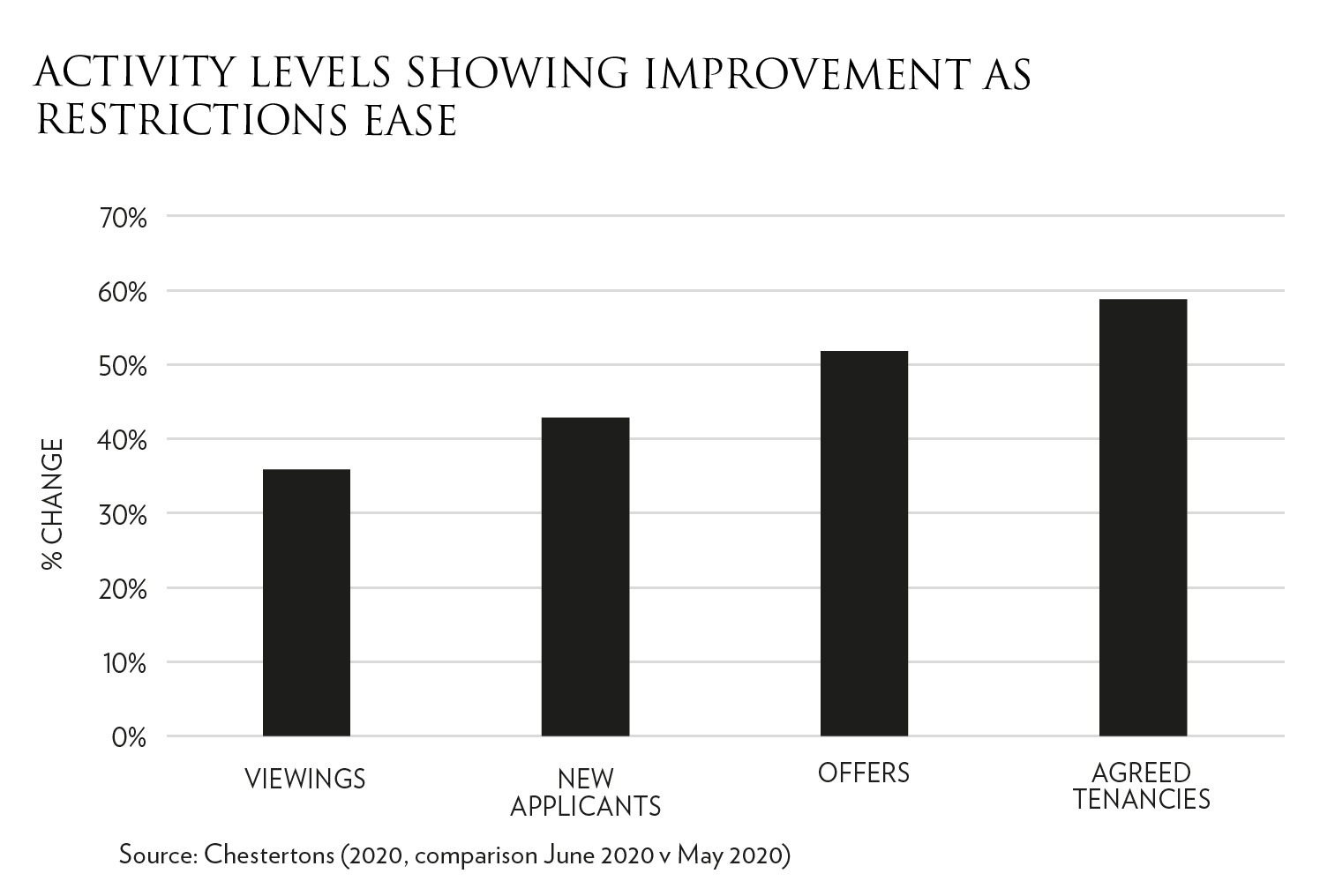

Since the market reopened there has been a steady rise in activity, particularly in the lower (less than £500 per week) and higher (£3000+) markets. The number of new prospective tenants registering was up by over a third on the five year average every week in June according to Knight Frank, with both Knight Frank and Chestertons reporting a surge in viewing numbers.

Since the market reopened there has been a steady rise in activity, particularly in the lower (less than £500 per week) and higher (£3000+) markets. The number of new prospective tenants registering was up by over a third on the five year average every week in June according to Knight Frank, with both Knight Frank and Chestertons reporting a surge in viewing numbers.

Prime markets were flooded with unlet stock from the short term market while there was no business or holiday travel. That inevitably put

downward pressure on prices. Average rents are 4.6% lower across prime London this June compared to a year ago (Knight Frank) and while

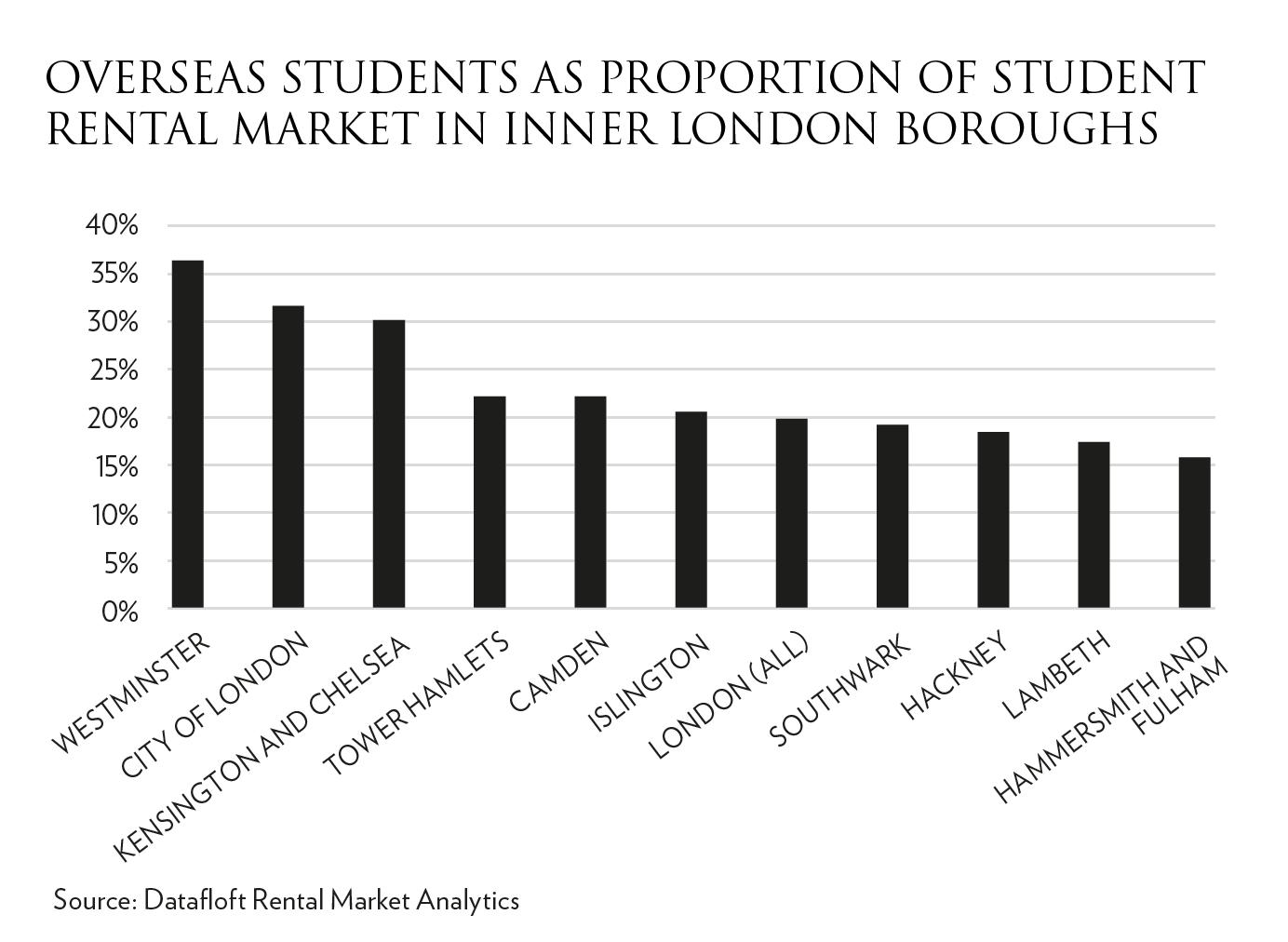

demand is returning, rents will remain attractive in the near term, with landlords keen to let properties ahead of the autumn. July to September is traditionally the busiest rental period in London, and more normality should be restored as borders are now open. The impact of COVID-19 on student numbers in the new academic year, particularly those from overseas, is as yet unknown. Like all global cities, London will keenly anticipate the return of business and leisure travellers as the economy reopens.

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023