Rental values have strengthened across the capital in recent months. Annual growth in rental values in London reached 0.9% in June, according to the official ONS IPHRP, representing the seventh consecutive month of positive price growth, May and June witnessing the strongest levels of annual growth since September 2017. Across prime central London rental values have risen 0.2% quarter on quarter according to Knight Frank, although remain slightly lower than a year ago (-0.5%). The Royal Institute of Chartered Surveyors indicate that sentiment among London surveyors for rental price growth over the next three months is at its highest in over three years, as levels of new rental instructions remain subdued.

Rental values have strengthened across the capital in recent months. Annual growth in rental values in London reached 0.9% in June, according to the official ONS IPHRP, representing the seventh consecutive month of positive price growth, May and June witnessing the strongest levels of annual growth since September 2017. Across prime central London rental values have risen 0.2% quarter on quarter according to Knight Frank, although remain slightly lower than a year ago (-0.5%). The Royal Institute of Chartered Surveyors indicate that sentiment among London surveyors for rental price growth over the next three months is at its highest in over three years, as levels of new rental instructions remain subdued.

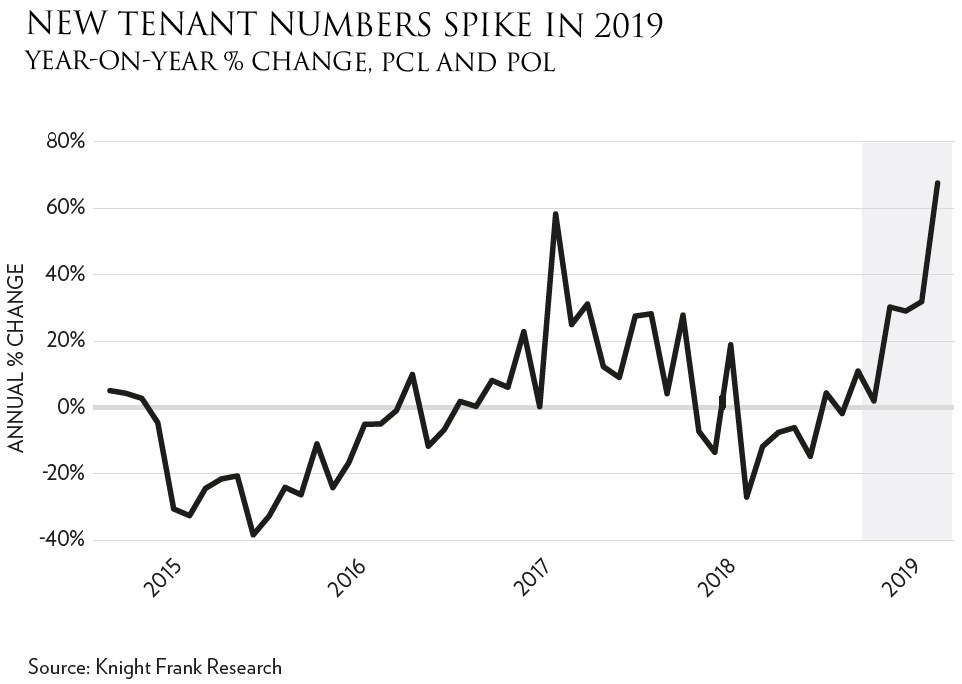

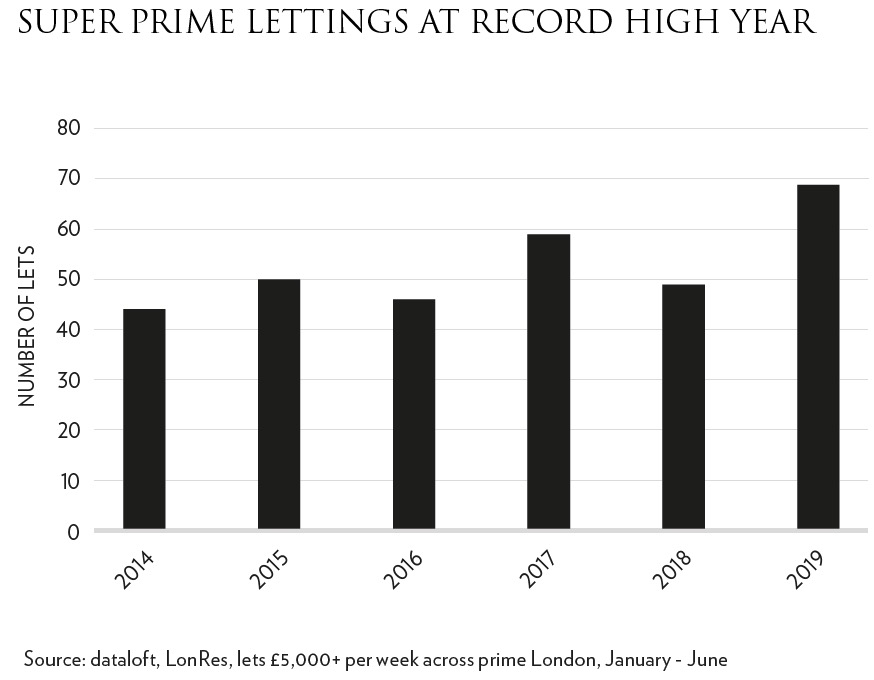

Knight Frank report the number of new prospective tenants registering in prime central and prime outer London rose by two-thirds in May, compared to the same month a year ago, with viewing figures rising by 20%. The introduction of the Tenant Fee ban on 1st June has undoubtedly impacted demand across the lower price brackets, while the ongoing political and Brexit manoeuvrings continue to push potential high-value purchasers towards the rental market until uncertainty abates. Data from LonRes and Knight Frank indicates that the super-prime market (+£5,000 per week) has recorded its strongest ever start to the year, with properties let across a suite of prime London’s exclusive postcodes.

Knight Frank report the number of new prospective tenants registering in prime central and prime outer London rose by two-thirds in May, compared to the same month a year ago, with viewing figures rising by 20%. The introduction of the Tenant Fee ban on 1st June has undoubtedly impacted demand across the lower price brackets, while the ongoing political and Brexit manoeuvrings continue to push potential high-value purchasers towards the rental market until uncertainty abates. Data from LonRes and Knight Frank indicates that the super-prime market (+£5,000 per week) has recorded its strongest ever start to the year, with properties let across a suite of prime London’s exclusive postcodes.

With demand rising and rental values on the increase, it is perhaps no surprise that a vast majority (72%) of buy-to-let investors still believe the sector offers the best, and least volatile, long-term investment. A survey by Benham & Reeves indicates that over half of those with buy-to-let investments in London plan to keep their portfolio for the next five years, a fifth stating that despite the uncertainty they may well expand over the next year.

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023