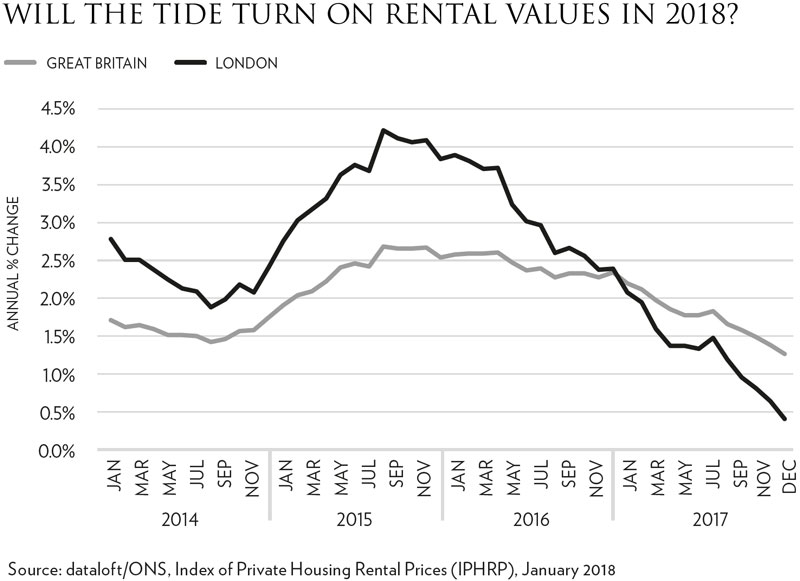

Average rental prices across Great Britain rose by 2.1% in the year to December according to the Office for National Statistics (ONS), the lowest annual increase since the index was started in January 2012. Rightmove report average asking rents rose by just 0.7% in the UK (excluding London) during 2017, their lowest rise since 2014. Across London, the ONS report rental price growth fell to 0.4% in December, the lowest level of annual growth since autumn 2010, while Knight Frank report average rents across prime central London fell 2.2% year-on-year in December.

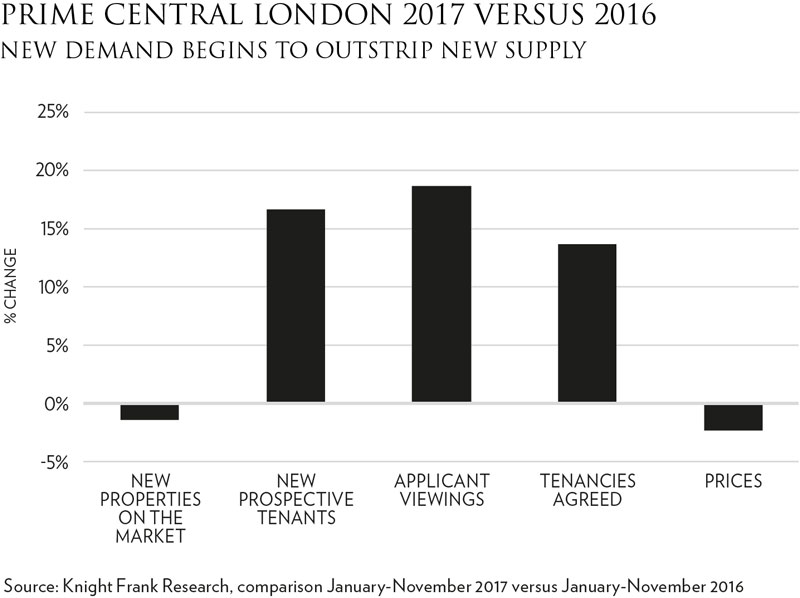

Rental value growth has been falling year-on-year for more than two years across the capital, mainly due to rising supply. Contributing factors include the surge in new lettings properties following the introduction of the additional 3% stamp duty levy in April 2016 and the muted sales market which has led to a growth in so-called ‘accidental’ landlords. However the pattern now looks to be reversing. Knight Frank recorded a like-for-like fall of 1.2% in the number of new lettings properties coming to the market between January and November 2017 versus the same period in 2016, with demand remaining strong. The agency note there was a 19% rise in viewings between January and November 2017 versus the same period in 2016, while the number of tenancies agreed rose by 14% over the same period.

Rental value growth has been falling year-on-year for more than two years across the capital, mainly due to rising supply. Contributing factors include the surge in new lettings properties following the introduction of the additional 3% stamp duty levy in April 2016 and the muted sales market which has led to a growth in so-called ‘accidental’ landlords. However the pattern now looks to be reversing. Knight Frank recorded a like-for-like fall of 1.2% in the number of new lettings properties coming to the market between January and November 2017 versus the same period in 2016, with demand remaining strong. The agency note there was a 19% rise in viewings between January and November 2017 versus the same period in 2016, while the number of tenancies agreed rose by 14% over the same period.

Although the number of new instructions fell across much of the market, data from LonRes reveals a 7% rise in the number of new instructions across prime London for properties with initial asking rental values of over £5000 per week. Demand here looks to be outpacing supply. The number of properties let in 2017 with rental values of £5000+ per week were up 34% on 2016 as many prospective purchasers are choosing to rent while the sales market is muted.

Although the number of new instructions fell across much of the market, data from LonRes reveals a 7% rise in the number of new instructions across prime London for properties with initial asking rental values of over £5000 per week. Demand here looks to be outpacing supply. The number of properties let in 2017 with rental values of £5000+ per week were up 34% on 2016 as many prospective purchasers are choosing to rent while the sales market is muted.

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023