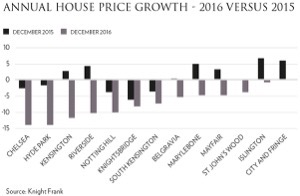

The end of 2016 proved busier than many expected for the prime London housing market. The UK House Price Index indicates that annual price growth (November 2015 to November 2016) across Greater London continues to outperform the rest of England and Wales (8.1% compared to 7.1%). Yet across prime central areas, Knight Frank report a 6.3% decrease and Savills a 6.9% decrease in average prices at the end of December 2016 compared to a year ago.

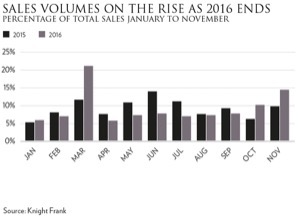

With vendors accepting the need to lower asking prices in response to the taxation changes and underlying economic uncertainty suppressing the prime London market, pent-up demand is slowly being released. November proved the second busiest month for sales in 2016 after the spike in transactional activity in March, with more activity than in either 2015 or 2014. In the run-up to and immediate aftermath of the referendum, sales volumes faltered. Sales in June were 38% lower than in 2015, by November the difference had halved to just 19%. In December, the Royal Institute of Chartered Surveyors noted that the number of new buyers had risen for the fourth consecutive month.

With vendors accepting the need to lower asking prices in response to the taxation changes and underlying economic uncertainty suppressing the prime London market, pent-up demand is slowly being released. November proved the second busiest month for sales in 2016 after the spike in transactional activity in March, with more activity than in either 2015 or 2014. In the run-up to and immediate aftermath of the referendum, sales volumes faltered. Sales in June were 38% lower than in 2015, by November the difference had halved to just 19%. In December, the Royal Institute of Chartered Surveyors noted that the number of new buyers had risen for the fourth consecutive month.

After a year in which the sub £1 million market proved the most resilient, the mid-market is now picking up. Knight Frank report a 9% rise in new buyer enquires for properties over £2 million in 2016 compared to 2015, while LonRes have recorded a number of high value ultra-prime sales over the final quarter of the year.

After a year in which the sub £1 million market proved the most resilient, the mid-market is now picking up. Knight Frank report a 9% rise in new buyer enquires for properties over £2 million in 2016 compared to 2015, while LonRes have recorded a number of high value ultra-prime sales over the final quarter of the year.

Predictions for 2017 are difficult. Consensus forecasts are for no growth across prime areas. The triggering of Article 50 and the impact of a new era for American politics are undoubtedly the two most significant events for the first quarter of 2017. However, long term, an average of forecasts suggests that prime central areas will witness compound growth of 10% by 2021 and London remains a destination of choice for those looking to live, work and invest.

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023