Rents across England and Wales are currently rising at their fastest annual rate since 2011 according to data from the Your Move buy-to-let index. Rental values rose by 3.4% on average over 2015. In London, rental values increased by 6.3%. This was only surpassed at a regional level by the East region, which witnessed a rental increase of 7.8%.

The Royal Institute of Chartered Surveyors (RICS) have stated that there was a rise in the number of letting agents reporting increased tenant demand in the fourth quarter of 2015. However, a rise in new instructions of properties to let also means that expectations for future rental levels are at their lowest level for two years.

The Royal Institute of Chartered Surveyors (RICS) have stated that there was a rise in the number of letting agents reporting increased tenant demand in the fourth quarter of 2015. However, a rise in new instructions of properties to let also means that expectations for future rental levels are at their lowest level for two years.

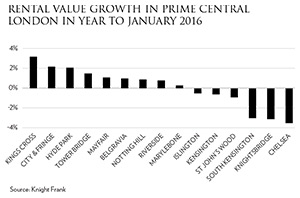

In prime central London, Knight Frank report that rental values rose by 0.2% in the 12 months to January 2016. The rate of annual rental growth peaked in May 2015 at 4.2%, with a slowdown reported thereafter. Along with uncertainty across the global financial markets, Knight Frank suggest that restructuring plans by major European Banks have impacted on demand for rental properties over the second half of 2015. The strongest rental growth in the last 12 months was seen in the the area around Kings Cross, followed by the City and Fringe. With rental growth slowing, gross yields across prime central London declined from 2.96% in May 2015 to 2.92% in January 2016.

In the past, occupiers looking to reside in London for even just a couple of years could have benefitted from purchasing properties. By doing so they would have been able to recoup the costs of buying once the property sold and the capital value appreciated. However, with the high stamp duty costs in the upper price thresholds, those looking at central London as a shorter term opportunity could be in a position where the rental outlay does not even match the stamp duty costs payable. This could boost the appeal of the rental market in central London. Despite this, continued uncertainty across the world’s financial markets on which the central London’s rental market is so intrinsically linked may restrict growth in demand in the short term.

In the past, occupiers looking to reside in London for even just a couple of years could have benefitted from purchasing properties. By doing so they would have been able to recoup the costs of buying once the property sold and the capital value appreciated. However, with the high stamp duty costs in the upper price thresholds, those looking at central London as a shorter term opportunity could be in a position where the rental outlay does not even match the stamp duty costs payable. This could boost the appeal of the rental market in central London. Despite this, continued uncertainty across the world’s financial markets on which the central London’s rental market is so intrinsically linked may restrict growth in demand in the short term.

- Douglas and Gordon Emerging Prime Index, January 2016

- Home Index, December 2015

- Knight Frank PCL Rental Index, January 2016

- Land Registry House Price Index, December 2015 – © Crown copyright 2015 Land Registry. © Crown copyright material is reproduced with the permission of Land Registry under delegated authority from the Controller of HMSO.

- Your Move Buy to Let Index, December 2015

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023