In the run-up to the UK General Election the prime London housing market was showing signs of stabilising with demand levels rising, prices stabilising and transaction levels showing tentative signs of improvement.

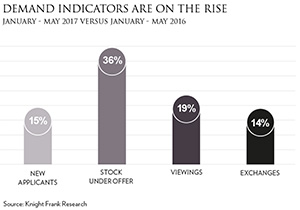

Knight Frank report that the number of exchanges recorded between January and May 2017 was 14.2% higher than in January to May 2016, while the number of prospective buyers was 15% higher than 2016, and up 6% on 2015. In terms of prices they assert that annual price falls across prime central London in June were -6.3% compared to -6.6% in May. Data from LonRes indicates that the average £psf value for properties across prime central London were -5.5% lower in June 2017 compared to the same period a year ago, down from -9.8% in April. With sales volumes also stabilising, such data suggests the price falls witnessed in 2016 are unlikely to be repeated this year.

Knight Frank report that the number of exchanges recorded between January and May 2017 was 14.2% higher than in January to May 2016, while the number of prospective buyers was 15% higher than 2016, and up 6% on 2015. In terms of prices they assert that annual price falls across prime central London in June were -6.3% compared to -6.6% in May. Data from LonRes indicates that the average £psf value for properties across prime central London were -5.5% lower in June 2017 compared to the same period a year ago, down from -9.8% in April. With sales volumes also stabilising, such data suggests the price falls witnessed in 2016 are unlikely to be repeated this year.

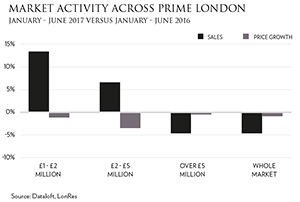

In terms of sales volumes, LonRes indicate that there were 25 deals across prime London for properties over £10 million during the first six months of 2017, compared to 29 over the same period last year. Deals of £5-10 million properties remained on par with the same six months last year. Activity in the £2-5 million and £1-2 million market has proved more buoyant, with increases of 6.8% and 13.8% in transaction volumes respectively.

In terms of sales volumes, LonRes indicate that there were 25 deals across prime London for properties over £10 million during the first six months of 2017, compared to 29 over the same period last year. Deals of £5-10 million properties remained on par with the same six months last year. Activity in the £2-5 million and £1-2 million market has proved more buoyant, with increases of 6.8% and 13.8% in transaction volumes respectively.

The reduced parliamentary majority will be unwelcome across London, although arguably its housing market since 2014 has been accustomed to uncertainty, thanks to the 2015 election, various changes to stamp duty land tax and Brexit. Evidence from previous elections indicates that the post-election pick-up in activity has traditionally begun almost immediately; while a weakened government may also mean that negotiations move towards a softer Brexit. This could prove encouraging for some investors, with any further falls in sterling making central London more attractive to overseas buyers.

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023