The first quarter of 2017 has seen markets stabilise across much of the prime London housing market. Transactions remain steady while the rate of price falls has slowed.

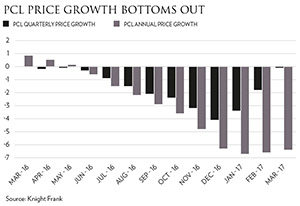

According to the UK House Price Index, the rate of annual price growth across London in February was 3.7%, down from 13.1% a year ago, and although Knight Frank assert that annual price growth across prime central London was -6.4% in the year to March, rates of price falls are easing. Savills indicate that prices fell by an average of just 0.3% across prime London areas during Q1 2017, compared to a fall of 2.2% during Q4 2016, with prices now 6.6% lower than their peak in 2014. In outer prime areas rates of fall remain slightly higher at 2.7% during Q1 2017, not dissimilar to the -2.4% witnessed during Q4 2016.

According to the UK House Price Index, the rate of annual price growth across London in February was 3.7%, down from 13.1% a year ago, and although Knight Frank assert that annual price growth across prime central London was -6.4% in the year to March, rates of price falls are easing. Savills indicate that prices fell by an average of just 0.3% across prime London areas during Q1 2017, compared to a fall of 2.2% during Q4 2016, with prices now 6.6% lower than their peak in 2014. In outer prime areas rates of fall remain slightly higher at 2.7% during Q1 2017, not dissimilar to the -2.4% witnessed during Q4 2016.

Alongside stabilising prices, stock levels remain low, while buyer activity has shown signs of an uptick. Knight Frank report that the number of properties under offer in February 2017 was 22% higher than in February 2016, with viewings up 25% and new buyers rising by 4%. Transaction levels for properties over £1 million in March 2017 were at their highest level since March 2016 (LonRes).

Alongside stabilising prices, stock levels remain low, while buyer activity has shown signs of an uptick. Knight Frank report that the number of properties under offer in February 2017 was 22% higher than in February 2016, with viewings up 25% and new buyers rising by 4%. Transaction levels for properties over £1 million in March 2017 were at their highest level since March 2016 (LonRes).

Even across the ultra-prime (£10 million plus) market, there appears to be a more balanced picture. Knight Frank report that more £20 million plus sales were conducted in Q1 2017 than since Q1 2014, while Savills note that the price fall across this market during Q1 2017 was just 0.8%, compared to a drop of 4.8% in Q4 2016.

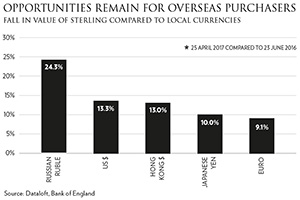

International buyers remain affected by the changes to SDLT and capital gains tax over the last two years, adding to their caution in taking advantage of sterling’s depreciation since the Referendum vote. Despite a rally in sterling after the news of a snap general election, sterling remains over 13% lower against the dollar and 10% lower against the Euro* offering opportunities for overseas purchasers.

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023