Rental values across London rose by 1.6% in the year to March, according to the Office for National Statistics Private Rental Index, while the decline across prime areas of the capital continued to ease. Knight Frank report that the annual rate of growth across prime London eased to -4.9% in March, with the quarterly rate of decline just 0.7%, the smallest quarterly decline since November 2015.

Stock levels across the rental market rose dramatically across London in 2016 as a result of buy-to-let purchases prior to the 3% second home levy in April, uncertainty over sales prices, and the impact of the EU referendum result. However, the rate of increase of new properties coming to the prime market has slowed during Q1 2017. The Association of Residential Lettings Agents (ARLA) noted that available rental stock fell during February, with Knight Frank reporting that while there were 23% more properties available to rent across prime London this February compared to last, this is significantly lower than the 51% annual increase experienced in June 2016.

Stock levels across the rental market rose dramatically across London in 2016 as a result of buy-to-let purchases prior to the 3% second home levy in April, uncertainty over sales prices, and the impact of the EU referendum result. However, the rate of increase of new properties coming to the prime market has slowed during Q1 2017. The Association of Residential Lettings Agents (ARLA) noted that available rental stock fell during February, with Knight Frank reporting that while there were 23% more properties available to rent across prime London this February compared to last, this is significantly lower than the 51% annual increase experienced in June 2016.

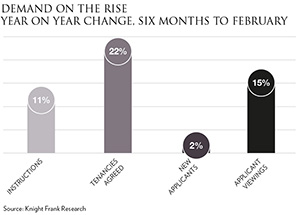

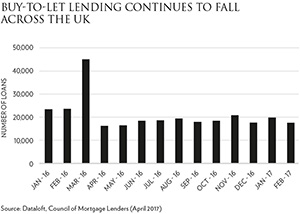

Although stock levels are easing, in part due to a significant fall in buy-to let lending, demand remains high. Across the prime central London market the number of new prospective tenants registering and the number of new lets agreed both rose in the six months to February, with the Royal Institute of Chartered Surveyors reporting that buyer demand rose for the fourth consecutive month in March. Knight Frank report that demand is particularly high at the extremes of the market. Continued high demand from students and young professionals has ensured activity below £1000 per week has remained robust and demand in the super-prime lettings market (£5000 per week) remains strong. LonRes report there were more deals agreed in this price bracket in Q1 2017 than in the latter quarter of 2016 with many choosing the option to rent while stock levels remain low and uncertainty remains across the sales market.

Although stock levels are easing, in part due to a significant fall in buy-to let lending, demand remains high. Across the prime central London market the number of new prospective tenants registering and the number of new lets agreed both rose in the six months to February, with the Royal Institute of Chartered Surveyors reporting that buyer demand rose for the fourth consecutive month in March. Knight Frank report that demand is particularly high at the extremes of the market. Continued high demand from students and young professionals has ensured activity below £1000 per week has remained robust and demand in the super-prime lettings market (£5000 per week) remains strong. LonRes report there were more deals agreed in this price bracket in Q1 2017 than in the latter quarter of 2016 with many choosing the option to rent while stock levels remain low and uncertainty remains across the sales market.

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023