Growth across London is slowing, with the average price of a property up just 1.3% in the month of August to £488,908 according to the UK House Price Index. While annual growth across London remains high (12.1%), all signs are that this will soften over the coming months. The latest survey by the Royal Institute of Chartered Surveyors reports that agents across the capital believe that price growth will fall into the autumn, with little change in prices expected over the next 12 months.

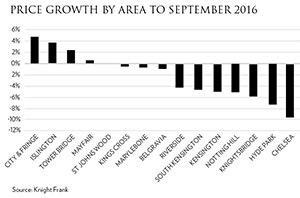

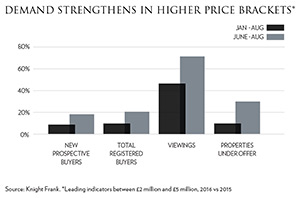

In prime central London (PCL), Knight Frank report that price growth in the year to September was -2.1%, although this masks significant regional divergences. While the lower end of the market, (properties less than £1 million), continues to perform best, Knight Frank believe activity above £2 million is showing tentative signs of improvement. The number of prospective buyers for properties priced £2 million – £5 million rose 8.7% this year compared to same period last year, while in the three months to the end of August viewings on properties between £2 and £5 million rose by more than 66% compared to the same period last year.

In prime central London (PCL), Knight Frank report that price growth in the year to September was -2.1%, although this masks significant regional divergences. While the lower end of the market, (properties less than £1 million), continues to perform best, Knight Frank believe activity above £2 million is showing tentative signs of improvement. The number of prospective buyers for properties priced £2 million – £5 million rose 8.7% this year compared to same period last year, while in the three months to the end of August viewings on properties between £2 and £5 million rose by more than 66% compared to the same period last year.

The unexpected Brexit result has undoubtedly been a catalyst for overdue price reductions. Vendors are finally accepting that in order to achieve a sale they need to take account of the stamp duty changes that have beset the market since the start of 2015. Favourable currency conditions from overseas buyers have helped create some momentum in recent months, although transaction levels remain nearly 20% down compared to 2015. It is clear that buyers remain cautious, with the average number of days property remained on the market 14% higher between January and August 2016 versus the same period in 2015.

The unexpected Brexit result has undoubtedly been a catalyst for overdue price reductions. Vendors are finally accepting that in order to achieve a sale they need to take account of the stamp duty changes that have beset the market since the start of 2015. Favourable currency conditions from overseas buyers have helped create some momentum in recent months, although transaction levels remain nearly 20% down compared to 2015. It is clear that buyers remain cautious, with the average number of days property remained on the market 14% higher between January and August 2016 versus the same period in 2015.

Knight Frank Residential Research, Prime Central London Sales Index, September 2016

Knight Frank Residential Research, Sales Map, Year to September 2016

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023