Rental values are diverging from current low inflation levels. They have reached an average of £816 per month across England and Wales, the highest average ever recorded.

LSL Property Services buy-to-let index shows that, despite marginal deflation in the wider economy, rents rose by 6.3% in the last year and by 1.6% from August to September. Since January 2010, discounting the impact of inflation, rents have risen by 10.3% in real terms.

London is one of five regions to see record levels of average rent, increasing by 11.6% over the 12 months to September to an average of £1,301 per month. The last month has recorded an increase of 1.8%, the second highest regional increase, exceeded only by the south east. This has contributed towards a 4.4% yield, rising from 4.3% in September last year.

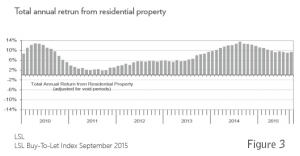

Gross rental yields across England and Wales for September now average 5.2%, which is a small increase on August 2015 and September last year when the figure was 5.1%. Combining this income with capital value gains results in an average total return of 9.4%. It represents an increase over the 8.9% total return recorded in August. Even when the market was performing poorly, average returns were positive. Now, returns are considered more sustainable than the figures approaching 14% seen in the middle of last year (see Figure 3).

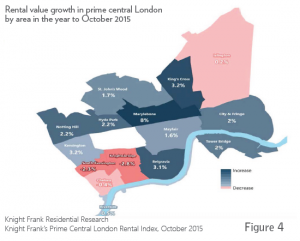

Properties in PCL are yielding an average of 2.95%. The PCL rental index from Knight Frank shows annual rental growth of just 1.5%, down from the peak of 4.2% in May. Rental values in October declined by 0.5%, the steepest fall in two years. The number of new tenancies has also dropped: it was 12% lower in September 2015 than September 2014.

The highest increase in rental values in the year to October 2015 were recorded in Marylebone (8%) and Kensington (3.2%) with Belgravia following at (3.1%). The steepest declines in rental values were registered in Knightsbridge (–2.8%) and South Kensington (–2.3%) where an easing in demand possibly from financial service sector tenants has adversely affected the market (Figure 4).

Despite a temporary hiatus in London’s short-term appeal, its global status was confirmed when it reclaimed the top spot in the Z/Yen Global Financial Centres Index. The British capital received a particularly favourable assessment following the general election in May 2015.

- LSL Property Services Buy-to-Let Index, September and October 2015

- Knight Frank’s Prime Central London Rental Index, September and October 2015

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023