London House Prices – The average property price across England and Wales rose 4.2% in the 12 months to September 2015 to reach £186,553, according to the Land Registry. London saw the highest annual change in values at 9.6%, with the average property now priced at just under £500,000. London also saw the highest monthly change at 1.8%.

London Boroughs – Only two London boroughs have average house prices over £1 million: Kensington & Chelsea and Westminster, but these two boroughs have seen some of the lowest annual rates of growth – 2.3% and 2.6% respectively. Some of the outer London boroughs have seen the most dramatic price rises. Average forecasts from agents indicate Greater London is expected to outperform prime central London over the next five years, with anticipated growth of 28.4% compared to 23.2% in PCL. This corresponds to increasing interest shown by buyers for high specification properties, with some buyers placing less emphasis on location.

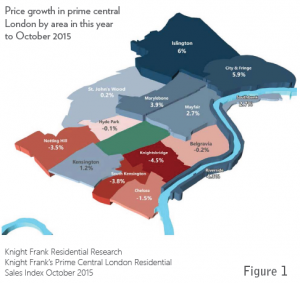

Prime Central London Prices – Annual house price growth in PCL slowed to just 1%, the lowest level since October 2009. Prices actually fell in October by 0.3%. The biggest annual declines were in Knightsbridge (–4.5%) and South Kensington (–3.8%) (see Figure 1). Some of the less traditional areas that have recently acquired the prime tag have seen more encouraging results. Islington leads the way with 6% growth, while City & Fringe achieved 5.9% growth. Of the more established west end locations, Marylebone demonstrated the most encouraging performance, with values increasing by 3.9%.

The impact of stamp duty reforms is being gradually revealed as the market settles. The last three months represented the first reliable test period of a market unaffected by issues such as elections and the traditional summer lull. Vendors are not always prepared to moderate their expectations to accommodate the increased costs arising from new stamp duty bands. Meanwhile, buyers are understandably concerned about the time it will take for house price growth to compensate for these additional purchase costs.

Interest from buyers is waning. Knight Frank reports the number of new prospective buyers being 30% down in September 2015 compared to September 2014. This has led to a downward revision in their 2016 price growth forecast from 4.5% to 2%. While this is disappointing news for some, the longer-term outlook for the capital remains positive as new buying opportunities are likely to be created in a less frenetic market.

Property Price Brackets – According to Land Registry data, the number of £1 million+ properties sold in London in July 2015 fell by 16% compared to July 2014. For properties over £2 million the drop was even more substantial: 26%. Across the capital, sales volumes were down 10% compared to a decline across England and Wales of 4%. Knight Frank recorded a heightened demand for quality in September, as buyers became more exacting in their requirements. Properties in good condition on a prime floor, square or street proved to be the most popular.

No other world city is home to more ultra-wealthy residents than London, as the latest Knight Frank Super Prime Development Focus reveals. Defined as those with more than $30 million to invest, London is expected to continue to appeal, with the population of UHNWIs expected to increase by 19% between 2014–2024.

While the range of locations being considered prime is expanding – both Regents Park and Marylebone have been emerging as prime locations in recent years – the demand for new buildings with amenities and more modern design within the “Golden Postcodes” has prompted developers in these areas to remain active.

2014 was an encouraging year for the super prime market, with the number of sales nearly doubling compared to 2012. The May 2015 election discouraged many from committing to purchases, with the threat of a mansion tax giving cause for concern. Despite the election result allying these fears, changes to stamp duty introduced in December 2014 increased acquisition costs for prime properties, and the summer budget sought to generate government revenue from IHT for properties held in company structures by removing the discrepancy for those with non-domiciled status. These factors help to explain the constrained growth seen in 2015 along with other recent tax changes such as the Annual Tax on Enveloped Dwellings (ATED) of March 2012 which were soon factored into the decision making process for buyers.

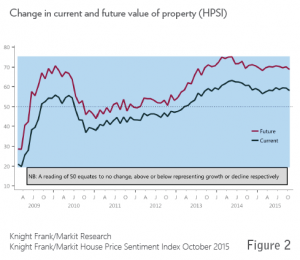

Current Price Sentiment – Knight Frank’s House Price Sentiment Index (HPSI), which measures UK household perceptions of current and future property values, saw expectations moderate but remain positive (see Figure 2). Households across all regions perceived that the value of their homes rose in October, while London residents were most confident that their properties had risen in value, a situation that has held true for 10 of the last 12 months. The index for London was also at its second highest level for a year.

Future Price Sentiment – The future HPSI for the UK dipped to its lowest level since February of this year. In contrast, London perceptions were not only higher than anywhere else in the UK but also more optimistic than at any point since November 2014. However, this level of confidence is not translating into moves. London bucks the national trend again in terms of households seeking to buy in the next 12 months. Nationally the figure has fallen to 4.6% of households, down from 5.9% in August and the lowest recorded by the survey. In the capital, we see encouraging signs for future interest in London property, with 6.9% of respondents expressing a keenness to find a new home within a year.

Interest from China – The recent state visit from China has helped bolster the relationship between the UK and the world’s second biggest economy. President Xi Jinping expressed his opinion that the UK plays an important role in the European Union and he hopes the upcoming referendum will result in the decision to stay.

The prime London market is intrinsically linked to political decisions such as this. HSBC has announced it will review the location of its global HQ, quoting issues such as the possibility of the UK leaving the EU as a reason for possible relocation. The bank’s decision is likely to be made early in 2016. While there may be some organisations faced with decisions such as these, London is not expected to lose its global appeal.

The author of the Y/Zen Global Financial Centres report states that even if the EU referendum results in a Brexit, this will not be followed by a mass exodus of businesses and investors. London’s fundamental qualities as a great place to do business – such as convenient time zones and an enriching lifestyle – will remain unassailable.

China’s central bank selected London as the first overseas destination for the sale of debt, with the debut sale on the first day of the president’s visit being oversubscribed. Demand for the 5 billion Renminbi pushed the final yield to 3.1% from a marketed rate of 3.3%.

- Land Registry House Price Index, September 2015 © Crown copyright 2015 Land Registry © Crown copyright material is reproduced with the permission of Land Registry under delegated authority from the Controller of HMSO

- Knight Frank’s Prime Central London Sales Index, October 2015

- Knight Frank’s House Price Sentiment Index (HPSI), September and October 2015

- Knight Frank’s London: Super-Prime Development Focus – 2015

- Bank of England Monetary Policy Summary – 5 November

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023