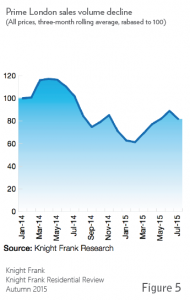

London remains one of the most appealing cities to the world’s wealthiest and most discerning buyers, but the high levels of capital growth seen in recent years is slowing to more sustainable levels. New legislation has discouraged some buyers looking for short term returns, and while the market is still absorbing the high stamp duty obligations some vendors remain unrealistic. Falling transaction volumes at the higher end of the market (see Figure 5) are thought to reflect a lack of demand, rather than supply.

While short term predictions suggest the market will see little if any capital appreciation this year, the longer term picture of cheap credit, employment growth, an increasing population and a relatively stable political environment compared to so many global alternatives, suggest demand in the medium to long term will remain strong.

The definition of “prime” in London is expanding as developers try to satisfy the demand for high specification properties and buyers become more flexible in relation to location. Areas such as Southbank, Regents Park and Marylebone are becoming first choice destinations for some, rather than simply a more affordable alternative.

GV believe the declines seen in capital growth and transaction activity are a result of potential buyers having difficulty quantifying the effect of a number of major events influencing the prime markets in London, mainly the stamp duty reforms and changes to the rules on non-dom status. Rather than confront these issues, some buyers are taking a more passive approach, waiting to see what the future holds. This has created something of a buyers’ market, with those willing to negotiate securing properties at more reasonable prices than we have seen in a very long time, in what is widely regarded as one of the world’s most important destination cities.

- Knight Frank’s Prime Central London Sales Index, October 2015

- Knight Frank’s The London Review, Autumn 2015

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023