There have been a number of changes to the UK tax regime over the past couple of years, with some more taking effect over the next 18 months. The changes will in all probability affect both UK and non-UK residents when buying or selling a residential property. The property taxes that should be taken into consideration are the Annual Tax on Enveloped Dwellings (ATED), the Stamp Duty Land Tax (STDL), the Capital Gains Tax (CGT), and the Mansion Tax, which may come into play next year, depending on the outcome of the UK general election in May 2015.

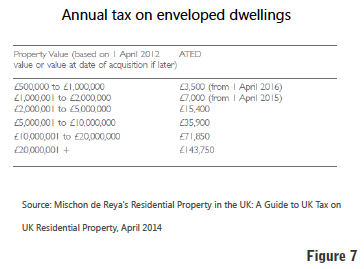

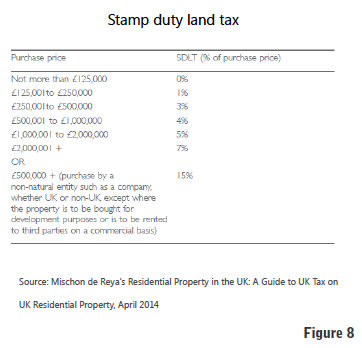

Following the budget announcement earlier this year, the original £2m+ threshold for the ATED and the STDL was lowered to include any properties valued over £500k, which were owned or purchased by companies that were not property investors or developers. The ATED extension will come into effect in April 2015, for £500k and £1m properties, and April 2016, for £1m and £2m properties, while the STDL extension came into effect in March 2014. Both taxes work on a sliding scale basis (see figures 7 and 8).

Following the budget announcement earlier this year, the original £2m+ threshold for the ATED and the STDL was lowered to include any properties valued over £500k, which were owned or purchased by companies that were not property investors or developers. The ATED extension will come into effect in April 2015, for £500k and £1m properties, and April 2016, for £1m and £2m properties, while the STDL extension came into effect in March 2014. Both taxes work on a sliding scale basis (see figures 7 and 8).

In addition to these changes, the budget also stipulated from April 2015, non-UK residents will have to pay a UK CGT when selling any residential properties in the UK, whether buy-to-lets or owner-occupied properties. Previously, if a UK property was personally owned, there would not have been any CGT to pay on the profits from a sale of the property, or on the market value of the property were it to be given as a gift. However, with the extension of the CGT to non-UK residents, from April 2013 onwards profits made by non-UK companies will be taxed at a rate of 28% on residential property valued at £2m+, where the property was occupied by a non-UK resident or their family. According to Mishcon de Reya, an international law firm with offices in London and New York, profits on properties with a value of £1m+ or £500k+ will also incur CGT from April 2015 and April 2016 respectively, when the ATED is applied to these properties.

In addition to these changes, the budget also stipulated from April 2015, non-UK residents will have to pay a UK CGT when selling any residential properties in the UK, whether buy-to-lets or owner-occupied properties. Previously, if a UK property was personally owned, there would not have been any CGT to pay on the profits from a sale of the property, or on the market value of the property were it to be given as a gift. However, with the extension of the CGT to non-UK residents, from April 2013 onwards profits made by non-UK companies will be taxed at a rate of 28% on residential property valued at £2m+, where the property was occupied by a non-UK resident or their family. According to Mishcon de Reya, an international law firm with offices in London and New York, profits on properties with a value of £1m+ or £500k+ will also incur CGT from April 2015 and April 2016 respectively, when the ATED is applied to these properties.

Mischon de Reya are also still expressing some concern over the government’s proposition to remove property owners’ right to choose a principal residence in order to benefit from the CGT exemption called Principal Residence Relief (PRR). This proposed change would affect anyone, including UK residents, who has more than one home, whether additional homes are in the UK or outside of it. Previously, CGT was paid only on profits from sales of properties that were not the principal residence. While UK, and now non-UK residents, will still be able to benefit from the PRR exemption, the proposition is to have the HM Revenue & Customs (HMRC) decide on which property would qualify as the principal residence, based on ‘demonstrable’ evidence. Also, the period in which property owners can sell their main home after moving out, without paying CGT, has been reduced from three years to 18 months.

However, what is causing more concern and uncertainty in the marketplace is the possible introduction of the so called ‘Mansion Tax’, following the UK general election in May, which would apply to all properties valued over £2m. First of all, according to Knight Frank, ‘Mansion Tax’ is a misnomer, as the vast majority of the £2m+ properties in Greater London this tax would affect are flats (38%) and terraced houses (36%), not ‘mansions’. Only 14% of £2m+ properties are detached and could therefore, be loosely called ‘mansions’, and a further 12% are semi-detached. The introduction of such a tax would also hit the prime central London (PCL) boroughs of Kensington and Chelsea, and Westminster the hardest, since 46% of all £2m+ residential properties across England and Wales are located there. Seeing as London’s £2m+ properties contributed over 80% of stamp duty revenues to the taxman’s coffers in 2013/14, HMRC cannot afford to drive PCL investors away, be they local or foreign.

- Mishcon de Reya Law Firm, The Budget Briefing, 2014;

- Mischon de Reya Law Firm, Residential Property in the UK: A Guide to UK Tax on UK Residential Property, April 2014;

- Mischon de Reya Law Firm, Government Hides Significant CGT Changes Affecting UK Residents in Plans to Tax Non Residents, May 2014;

- Knight Frank’s Prime Central London Sales Index, September 2014.

Past issues

- Spring 2014

- Summer 2014

- Autumn 2014

- Winter 2015

- Spring 2015

- Autumn 2015

- Winter 2016

- Spring 2016

- Summer 2016

- Autumn 2016

- Winter 2017

- Spring 2017

- Summer 2017

- Autumn 2017

- Winter 2018

- Spring 2018

- Summer 2018

- Autumn 2018

- Winter 2019

- Spring 2019

- Summer 2019

- Autumn 2019

- Winter 2020

- Summer 2020

- Autumn 2022

- Winter 2023

- Spring 2023